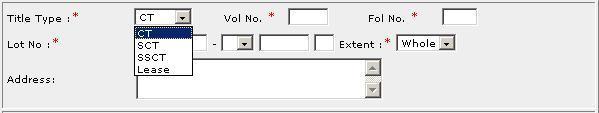

Select the Title Type [D].

Select either CT (Certificate of Title), SCT (Subsidiary

Certificate of Title) or SSCT (Subsidiary Strata Certificate

of Title).

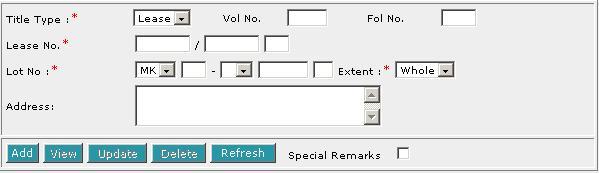

If Lease is selected, enter the Lease No. [T].

| DESCRIPTION OF LAND |

This section allows you to enter the description of land. The compulsory data items are indicated by an * marked in red.

To create a record:

| 1. |

|

| 2. |

|

| 3. | Enter the Vol No [T] and Fol No [T]. |

| 4. | Select the MK (Mukim) or TS (Town Subdivision) and enter the rest of the Lot No. [D, T]. |

| 5. | Enter Address [S]. |

| 6. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

If you selected Part in the Extent field, then PLOT/UNIT AND CHILD LOT DETAILS section must be filled in.

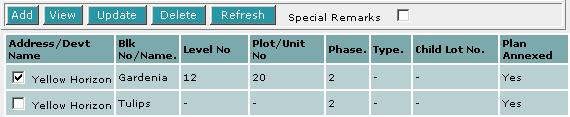

| PLOT/UNIT AND CHILD LOT DETAILS |

This section is compulsory if the Extent field is selected as Part in the DESCRIPTION OF LAND section.

To create a record:

| 1. |

|

| 2. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |  Select the check box(es) of the record(s) to be deleted. |

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

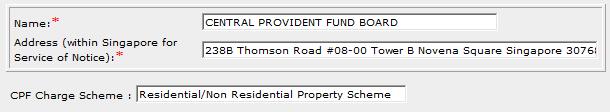

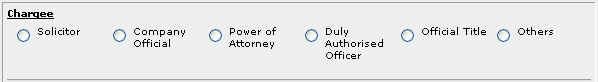

| CHARGEE |

This section allows you to enter the Chargee details. The Name [T] and the Address [T] are defaulted to CPF and the address of CPF each time you enter the screen. However, you may change the data if necessary.

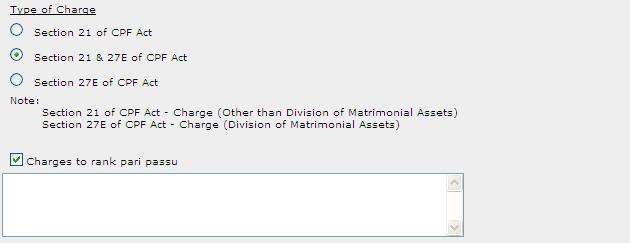

You need to select Type of Charge:

If Type of Charge selected is Section 21 & 27E of CPF Act or Section 27E of CPF Act, Charges to rank pari passu [C] is mandatory. Please enter data in the free text box provided.

| REGISTERED PROPRIETOR / CHARGOR |

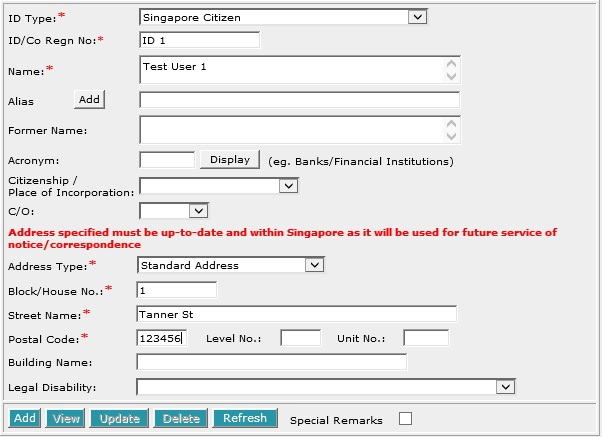

This section allows you to enter the details of the Registered Proprietor. The compulsory data items are indicated by the * marked in red.

To create a record:

| 1. |  Enter the data. For example, ID/Co Regn No. [T], Name [S], Block/House No.[T], Street Name [T] and Postal Code [T]. |

| 2. |

To enter alias(es):

You may enter the aliases in the text box provided. To add more Aliases, click on Add [B] and enter the name in the text box provided. Repeat the previous steps to add more records. You may enter up to 5 aliases. Empty alias fields will automatically be deleted when the screen is refreshed. |

| 3. |

To indicate legal disability:

If you wish to indicate that a party is under a Legal Disability [D], you may select from the list provided. You may then enter the details of the representative and supporting documents in the text boxes provided. To add more representatives or supporting documents click on Add [B] next to the respective headers. You may add up to 5 records each. Click on Del [B] to remove any redundant rows. |

| 4. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

Note:

Information entered in this section will be used for the generation of the CERTIFICATE OF CORRECTNESS.

| OPERATIVE CLAUSE |

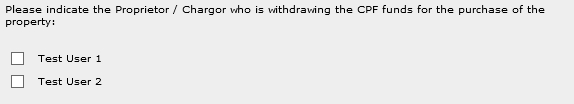

The contents of this section is dependent on the CHARGEE and REGISTERED PROPRIETOR sections.

If Type of Charge [R] selected under Chargee section is

- Section 27E of CPF Act under Residential/Non Residential Property Scheme;

the standard operative clause applies.Otherwise, if there are more than one registered proprietor entered in the previous section, you will be prompted:

![]()

Select Yes or No.

If you select Yes, then you may proceed to the next section.

If you select No, then the name(s) of the registered proprietor(s) from the previous section will be displayed. Select the check box(es) of the registered proprietor(s) who is/are withdrawing the CPF funds for the purchase of the property. You may select one or more check boxes but not all.

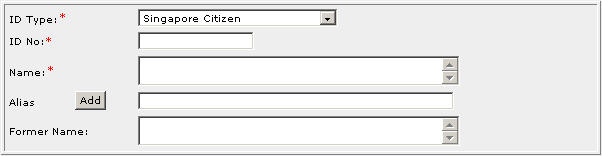

| PARTICULARS OF OUTGOING MEMBER |

The contents of this section is dependent on the CHARGEE section.

If Type of Charge [R] selected under Chargee section is

Section 21 of CPF Act

If Type of Charge [R] selected under Chargee section is

(a) Section 21 & 27E of CPF Act

(b) Section 27E of CPF Act

| 1. |  Enter the data. For example, ID No. [T], Name [S] and Former Name [S]. |

| 2. |

To enter alias(es):

You may enter the aliases in the text box provided. To add more Aliases, click on Add [B] and enter the name in the text box provided. Repeat the previous steps to add more records. You may enter up to 5 aliases. Empty alias fields will automatically be deleted when the section is revisited. |

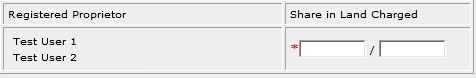

| SHARE IN LAND AFFECTED |

This section is dependent on the information entered in the REGISTERED PROPRIETOR section.

To reflect that the Application to Notify Charge is in respect of Whole Land, select Yes next to the question Is the Application to Notify Charge in respect of Whole Land?

![]()

When Is the Application to Notify Charge in respect of Whole Land [D] is No, the name(s) of the Registered Proprietor(s) from the previous section will be displayed.

| 1. |  Enter the Share in Land Charged [T]. |

| 2. | For example, the Chargors are registered proprietors of

1/2 share in land and you wish to reflect that the Application to

Notify Charge is in respect of this 1/2 share in land. In such a

case, enter data as follows:

|

| DATE OF APPLICATION |

![]()

Enter the Date of Application [T].

This is a compulsory data item as indicated by an * marked in red. However, if you are not in a position to enter the date at the time of preparation of the form, you may enter the date prior to submission for lodgment. You will be given a reminder message "Please ensure Date is entered before submission. Click [OK] to proceed or [Cancel] to enter now".

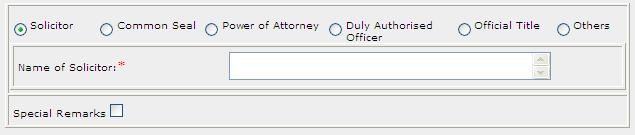

| EXECUTION BY CHARGEE / CHARGEE'S SOLICITOR |

| 1. | Select the appropriate mode of execution. |

| 2. | Please proceed to fill data according to the radio button selected. Apart from the mode Others [R], the Execution Clause will be generated automatically. Please see Modes of Execution for details. |

| SIMILAR INTEREST CONFIRMATION (if any) |

This section allows you to enter the similar interest confirmation.

To create a record:

| 1. |

For example, you are the solicitor acting for the Chargee, then you may enter the party type "Chargee" or party name as in the above example. These are all the information you need to enter. The Similar Interest Confirmation will be generated automatically. |

| 2. | Select the appropriate mode of execution. |

| 3. | Proceed to fill data accordingly to the radio button selected. Apart from the mode Others [R], the Similar Interest Confirmation will be generated automatically. If you have selected Others [R], you will be required to type the Similar Interest Confirmation in full. Please see Modes of Execution for Similar Interest Confirmation for details. |

| 4. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

| CERTIFICATE OF CORRECTNESS |

| 1. |

Select the appropriate mode of execution. |

| 2. | Please proceed to fill data according to the radio button selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please see Modes of Execution for Certificate of Correctness for details. |

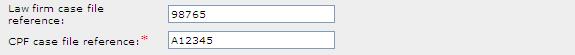

| CASE FILE REFERENCE |

This optional section allows you to enter your case file reference or the CPF case file reference.

| 1. | Enter the Law firm case file reference [T] if necessary. |

| 2. | Enter the CPF case file reference [T] . |