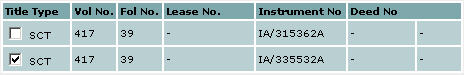

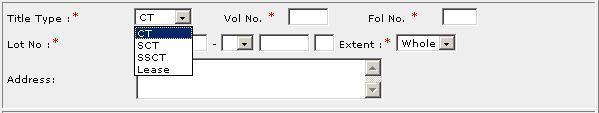

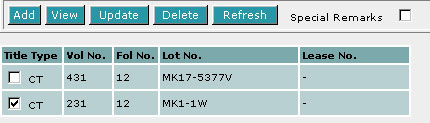

This section allows you to enter the description of the land. The compulsory

data items are indicated by an * marked in red.

To create a record:

| 1. |

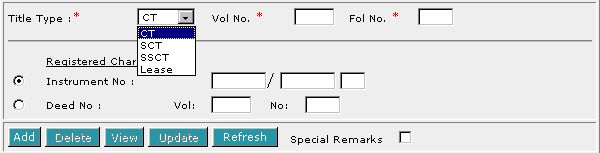

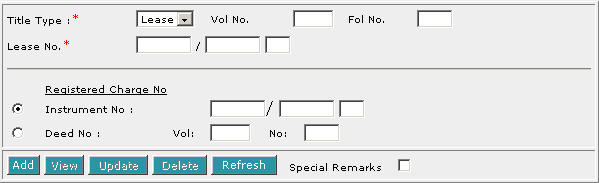

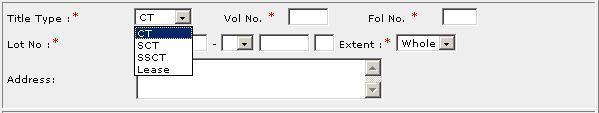

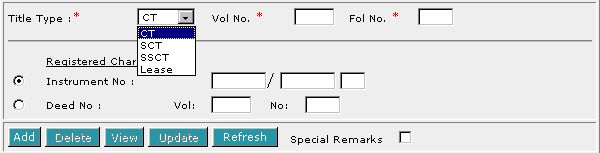

Select the Title Type [D].

|

| 2. |

If CT (Certificate of Title), SCT (Subsidiary

Certificate of Title) or SSCT (Subsidiary Strata Certificate

of Title) is selected, enter Vol No [T] and Fol No [T].

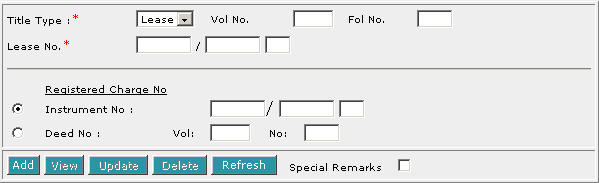

If Lease is selected, enter the Lease No [T].

|

| 3. |

Select Instrument No [R] or Deed No [R]. There

must be at least one Registered Charge No. |

| 4. |

If you have selected Instrument No [R], enter the Instrument

No [T]. If you have selected Deed No [R], enter Vol

[T] and No [T]. |

| 5. |

Click on Add [B]. Repeat the previous steps to add

more records. |

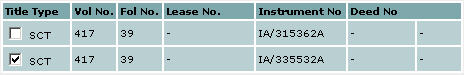

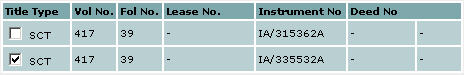

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

Back to Forms

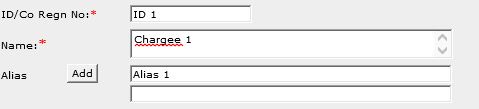

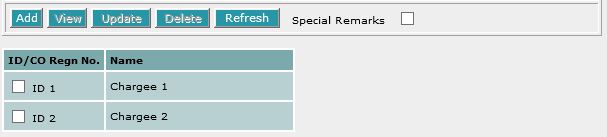

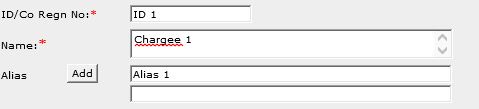

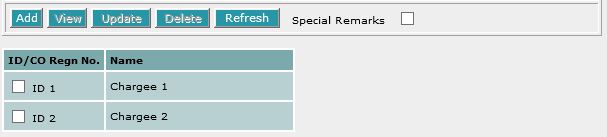

This section allows you to enter the details of the above parties. The compulsory

data items are indicated by an * marked in red.

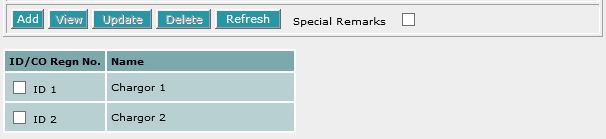

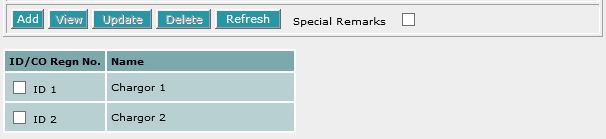

To create a record:

| 1. |

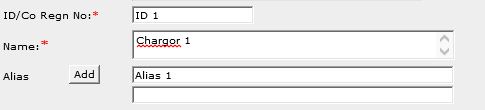

Enter the data. For example, ID/Co Regn No. [T], Name [S],

Block/House No.[T], Street Name [T] and Postal Code [T].

|

| 2. |

To enter alias(es):

You may enter the aliases in the text box provided. To add more Aliases,

click on Add [B] and enter the name in the text box provided. Repeat

the previous steps to add more records. You may enter up to 5 aliases.

Empty alias fields will automatically be deleted when the screen is refreshed.

|

| 3. |

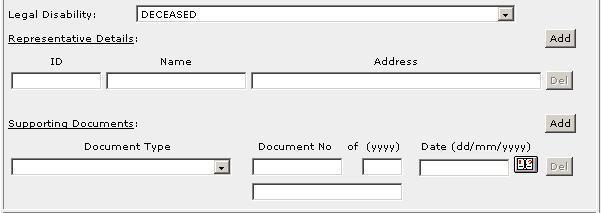

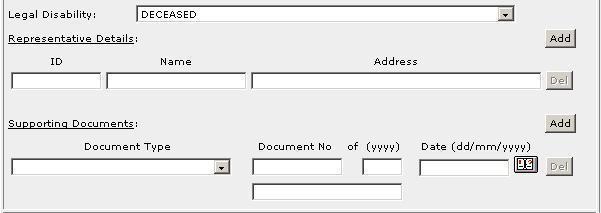

To indicate legal disability:

If you wish to indicate that a party is under a Legal Disability [D],

you may select from the list provided. You may then enter the details

of the representative and supporting documents in the text boxes provided.

To add more representatives or supporting documents click on Add [B]

next to the respective headers. You may add up to 5 records each. Click

on Del [B] to remove any redundant rows.

|

| 4. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

Note:

Information entered in this section will be used for the generation of the

EXECUTION and the CERTIFICATE

OF CORRECTNESS where applicable.

Back to Forms

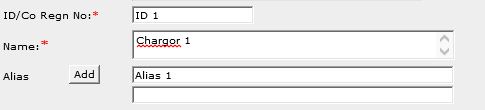

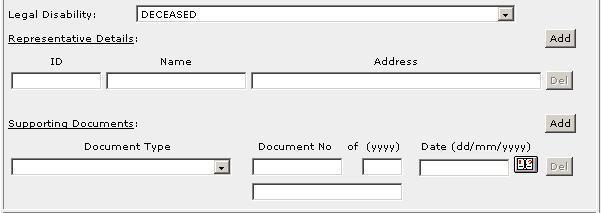

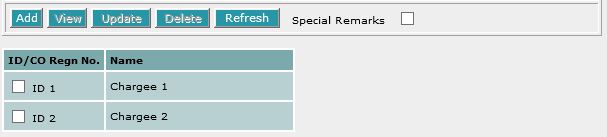

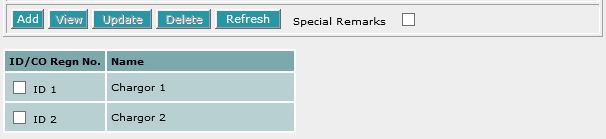

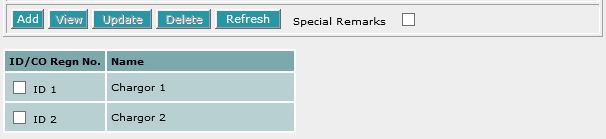

This section allows you to enter the details of the above parties. The compulsory

data items are indicated by the * marked in red.

To create a record:

| 1. |

Enter the data. For example, ID/Co Regn No. [T], Name [S],

Block/House No.[T], Street Name [T] and Postal Code [T].

|

| 2. |

To enter alias(es):

You may enter the aliases in the text box provided. To add more Aliases,

click on Add [B] and enter the name in the text box provided. Repeat

the previous steps to add more records. You may enter up to 5 aliases.

Empty alias fields will automatically be deleted when the screen is refreshed.

|

| 3. |

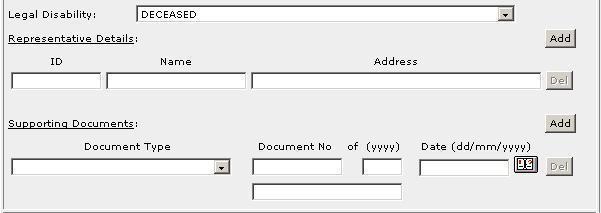

To indicate legal disability:

If you wish to indicate that a party is under a Legal Disability [D],

you may select from the list provided. You may then enter the details

of the representative and supporting documents in the text boxes provided.

To add more representatives or supporting documents click on Add [B]

next to the respective headers. You may add up to 5 records each. Click

on Del [B] to remove any redundant rows.

|

| 4. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

Note:

Information entered in this section will be used for the generation of the

CERTIFICATE OF CORRECTNESS

where applicable.

Back to Forms

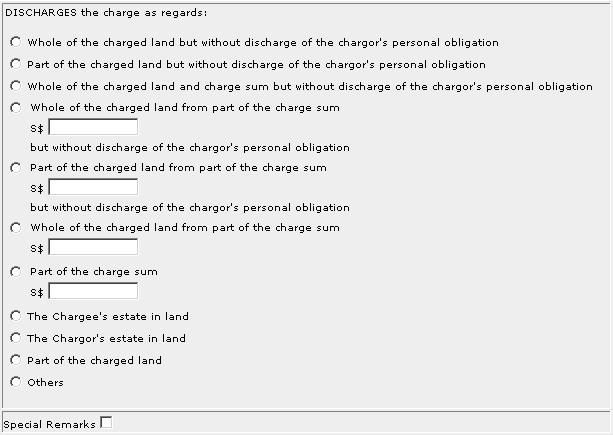

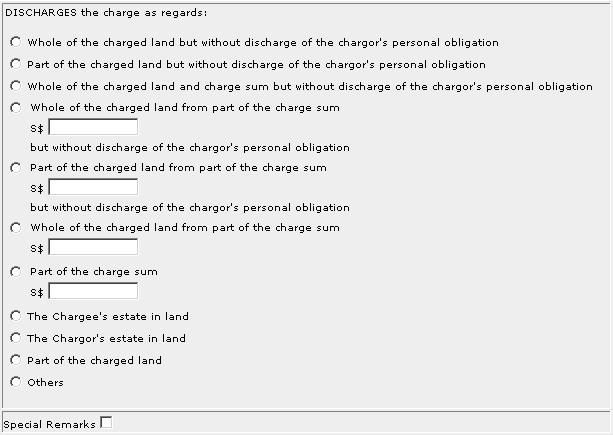

This section allows you to enter the consideration details.

| 1. |

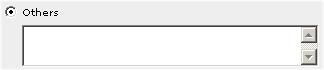

Select one of the consideration options and enter the charge sum if

applicable. If Others [R] is selected, you may enter the consideration

details in the free text area provided.

|

Special Remarks

Back to Forms

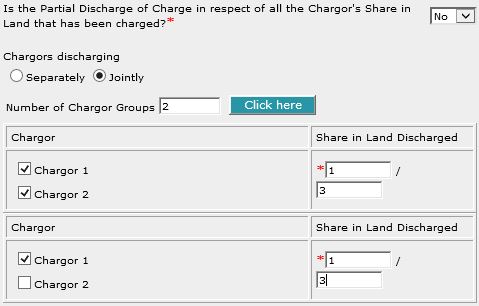

This section allows you to enter the share in land affected.

You will need to specify if the Partial Discharge of Charge is in respect of

Whole of Land.

If the option selected in the CONSIDERATION

section is other than "The Chargee's estate in land" and "The

Chargor's estate in land", you will be prompted:

| 1. |

Select Yes or No to the question above.

|

| 2. |

If you have selected No, no further entries are

required.

|

| 3. |

If you have selected Yes, a free text box will be provided.

You may describe the share in land in the free text area as provided.

|

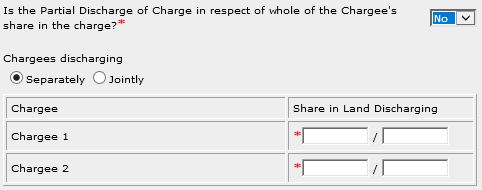

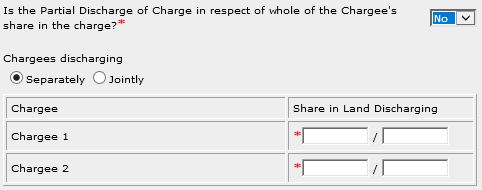

If the option selected in the CONSIDERATION

section is "The Chargee's estate in land", you will be prompted with:

| 1. |

Select Yes or No to the question above.

|

| 2. |

If you have selected Yes, no further entries are

required.

|

| 3. |

If you have selected No, specify if the chargees are

discharging their interest separately [R] or jointly [R].

| - |

select separately [R] if the chargees are

discharging their respective shares. Proceed to step 4. |

| - |

select jointly [R] if the chargees are

discharging their interest jointly. Proceed to step 5. |

|

| 4. |

If the land is discharged separately, enter the Share In Land

Discharging

[T] as absolute share in the whole land.

|

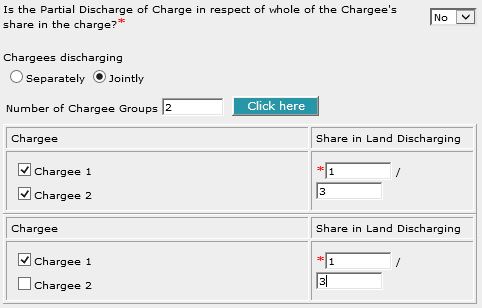

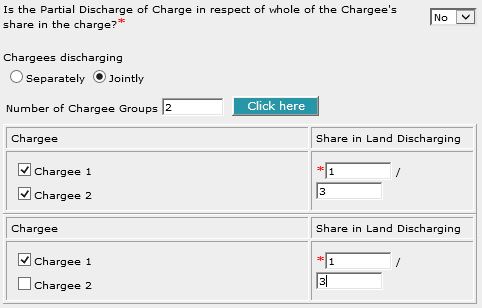

| 5. |

If the land is discharged jointly, enter the Number of Chargee Group

[T]. System will retrieve all the names entered in the CHARGEE

sections

and display them in as many groups as you have indicated. For each

group, select the relevant party or parties and indicate the Share in

Land Discharging [T].

For example, Felix Ling and The Drescher Bank of Singapore Limited are

discharging as joint

tenants of 1/3 share in land. In addition, Felix Ling is discharging party of another 1/3 share in land. As such, there

are 2 chargee groups. Therefore, enter "2" in the Number

of Chargee Groups [T]. Click on the command button next to it and

enter the data as required.

|

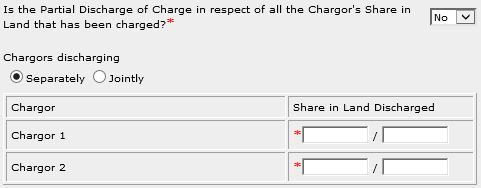

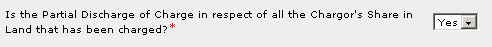

If the option selected in the CONSIDERATION

section is "The Chargor's estate in land", you will be prompted with:

| 1. |

Select Yes or No to the question above.

|

| 2. |

If you have selected Yes, no further entries are

required.

|

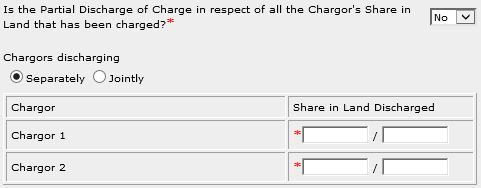

| 3. |

If you have selected No, specify if the chargors are

discharging their interest separately [R] or jointly [R].

| - |

select separately [R] if the chargors are

discharging their respective shares. Proceed to step 4. |

| - |

select jointly [R] if the chargors are

discharging their interest jointly. Proceed to step 5. |

|

| 4. |

If the land is discharged separately, enter the Share In Land

Discharged [T] as absolute share in the whole land.

|

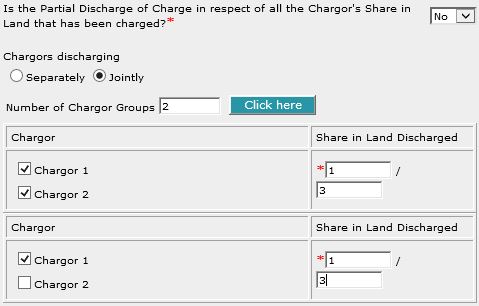

| 5. |

If the land is discharged jointly, enter the Number of Chargor Group

[T]. System will retrieve all the names entered in the CHARGOR

sections

and display them in as many groups as you have indicated. For each

group, select the relevant party or parties and indicate the Share in

Land Discharged [T].

For example, Cornelius Wong and The Hong Kong Banksia Corporation Limited are

discharging as joint

tenants of 1/3 share in land. In addition, Cornelius Wong is discharging

party of another 1/3 share in land. As such, there

are 2 chargor groups. Therefore, enter "2" in the Number

of Chargor Groups [T]. Click on the command button next to it and

enter the data as required.

|

Special Remarks

Back to Forms

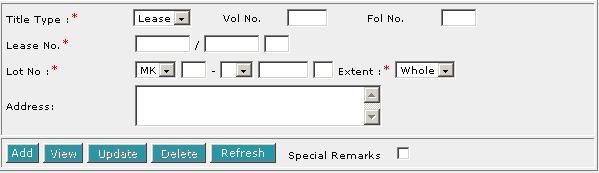

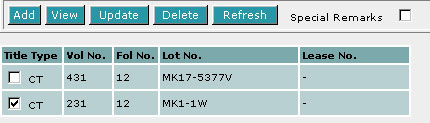

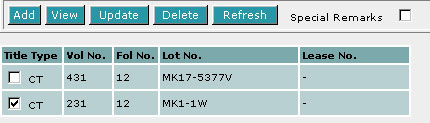

| DESCRIPTION

OF LAND TO BE DISCHARGED |

This section allows you to enter the description of land to be discharged.

When the option "part of the charged land" is selected in the Consideration section, this section

is mandatory. The compulsory data items are indicated by an *

marked in red.

To create a record:

| 1. |

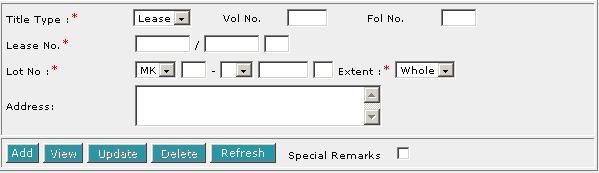

Select the Title Type [D].

|

| 2. |

Select either CT (Certificate of Title), SCT (Subsidiary

Certificate of Title) or SSCT (Subsidiary Strata Certificate

of Title).

If Lease is selected, enter the Lease No. [T].

|

| 3. |

Enter the Vol No [T] and Fol No [T]. |

| 4. |

Select the MK (Mukim) or TS (Town

Subdivision) and enter the rest of the Lot No. [D, T]. |

| 5. |

Enter Address [S]. |

| 6. |

Click on Add [B]. Repeat the previous steps to add

more records. |

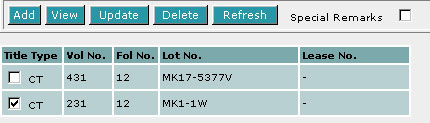

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

If you selected Part in the Extent field, then PLOT/UNIT

AND CHILD LOT DETAILS section must be filled in.

Back to Forms

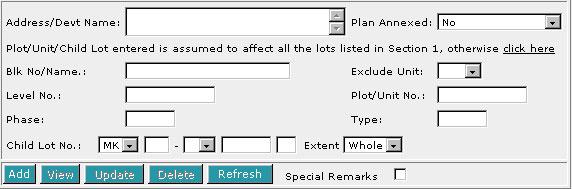

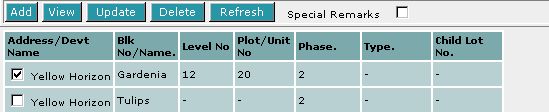

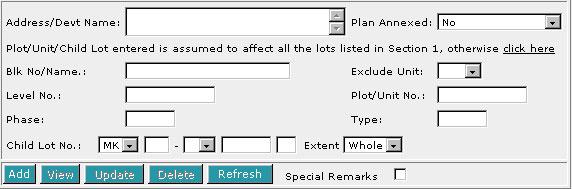

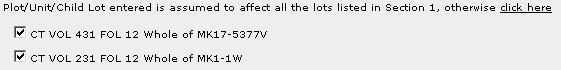

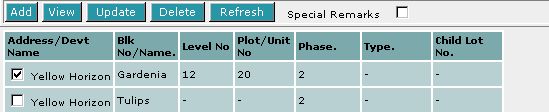

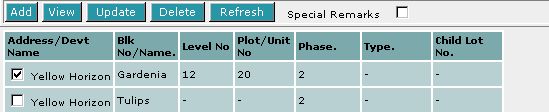

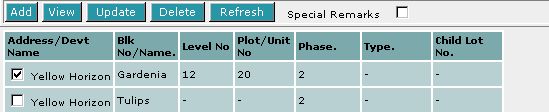

| PLOT/UNIT

AND CHILD LOT DETAILS |

This section is compulsory if the Extent field is selected as Part

in the DESCRIPTION OF LAND TO BE DISCHARGED section.

To create a record:

| 1. |

Enter the data as required. If you enter both the particulars of the Unit

as well as the Child lot number within the same screen, it is assumed

that both refer to the same property.

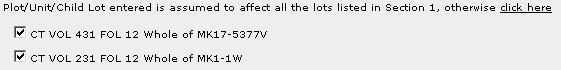

The Plot/Unit/Child Lot entered is assumed to affect all the lots listed

in DESCRIPTION OF LAND TO BE DISCHARGED section. If this is not

the case and you wish to specify a particular lot, then click on "click

here" [H]. The screen will display all the lots from the

DESCRIPTION OF LAND TO BE DISCHARGED section. Select the lot

that is relevant to your Plot/Unit/Child Lot.

|

| 2. |

Click on Add [B]. Repeat the previous steps to add

more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted. |

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen.

|

Special Remarks

Back to Forms

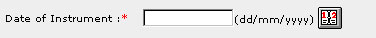

Enter the Date of Instrument [T].

This is a compulsory data item as indicated by an *

marked in red. However, if you are not in a position

to enter the date at the time of preparation of the form, you may enter the

date prior to submission for lodgment. You will be given a reminder message "Please ensure Date is entered before submission.

Click [OK] to proceed or [Cancel] to enter now"

Back to Forms

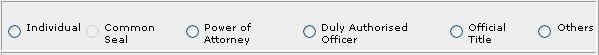

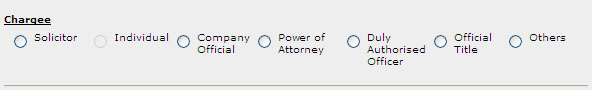

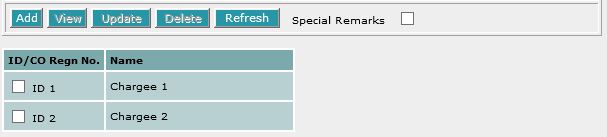

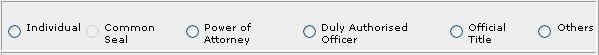

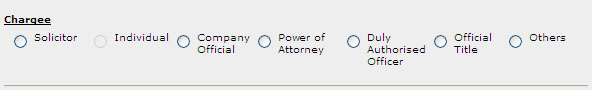

This section is dependent on the information entered in the CHARGEE

section.

If there is only one chargee entered in previous section, you will be prompted:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

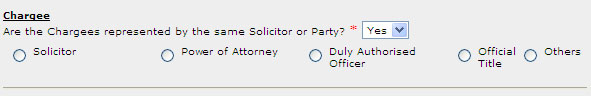

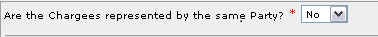

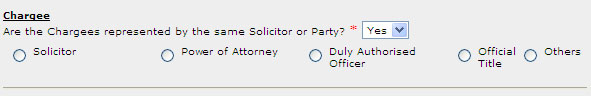

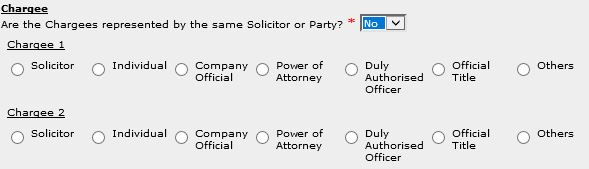

If there are more than one chargee entered in previous section, you will be

prompted:

Select Yes or No.

If you have selected Yes:

| 1. |

Select the appropriate mode of execution. |

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

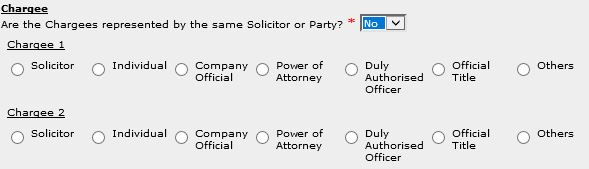

If you have selected No:

For each chargee:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

Special Remarks

Back to Forms

| CERTIFICATE

OF CORRECTNESS |

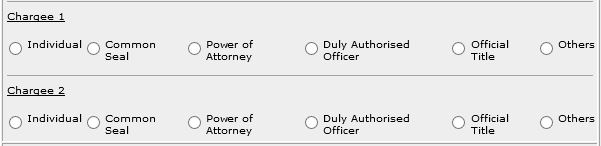

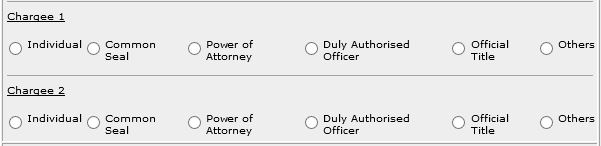

This section is dependent on the information entered in the CHARGEE section.

If there is only one party entered in previous sections, you will be prompted:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please

see Modes of

Execution for Certificate of Correctness for details. |

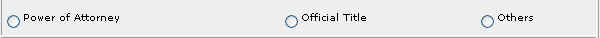

If there are more than one party entered in previous section, you will be prompted:

Select Yes or No. The example above shows the mode

of execution that are available if Yes is selected.

The example above shows the mode of execution that are available if No

is selected.

For each party:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please

see Modes of

Execution for Certificate of Correctness for details. |

Special Remarks

Back to Forms

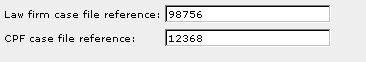

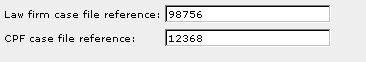

This optional section allows you to enter your case file reference or the CPF

case file reference.

| 1. |

Enter the Law firm case file reference [T] if necessary. |

| 2. |

Enter the CPF case file reference [T] if necessary. |

Back to Forms