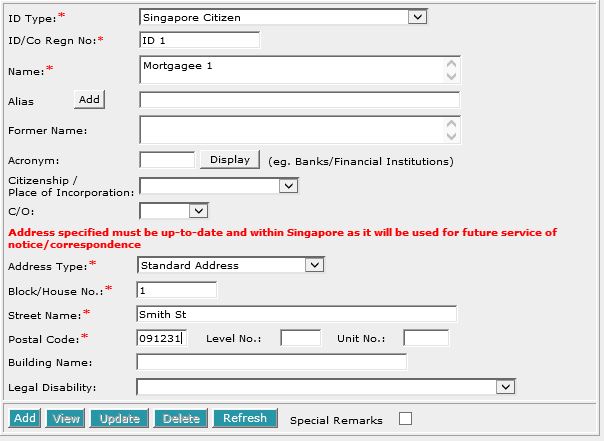

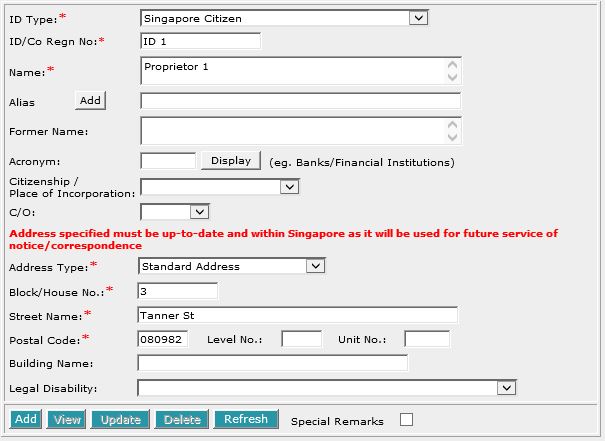

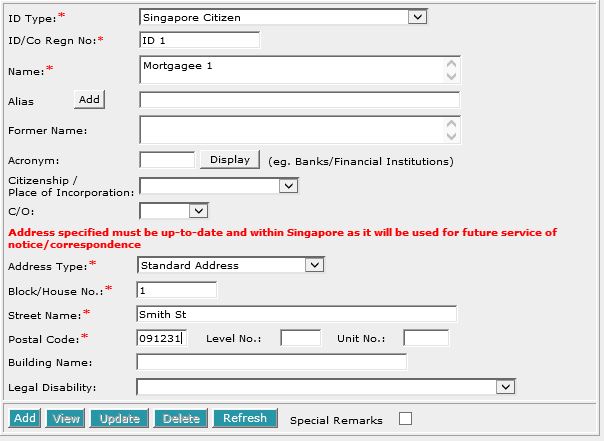

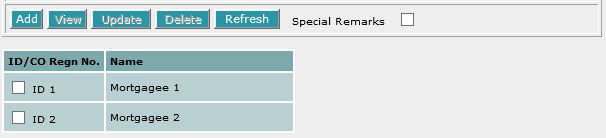

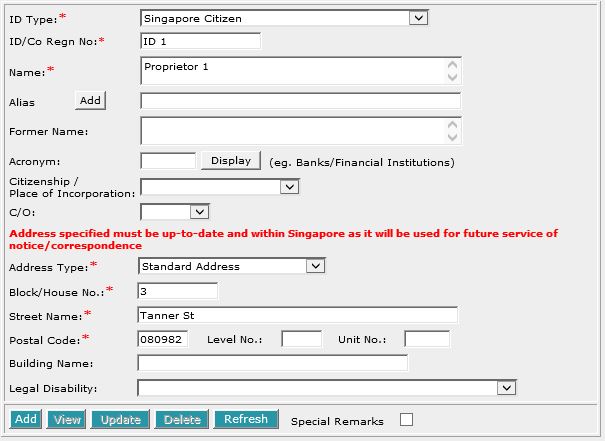

This section allows you to enter the details of the above parties. The compulsory

data items are indicated by an * marked in red.

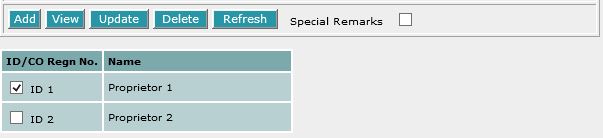

To create a record:

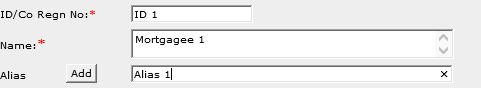

| 1. |

Enter the data. For example, ID/Co Regn No. [T], Name [S],

Block/House No.[T], Street Name [T] and Postal Code [T].

|

| 2. |

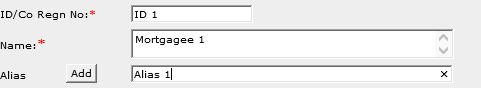

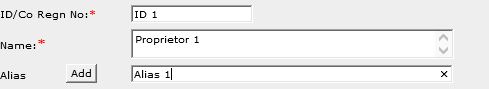

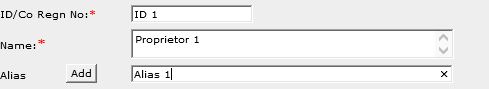

To enter alias(es):

You may enter the aliases in the text box provided. To add more Aliases,

click on Add [B] and enter the name in the text box provided. Repeat

the previous steps to add more records. You may enter up to 5 aliases.

Empty alias fields will automatically be deleted when the screen is refreshed.

|

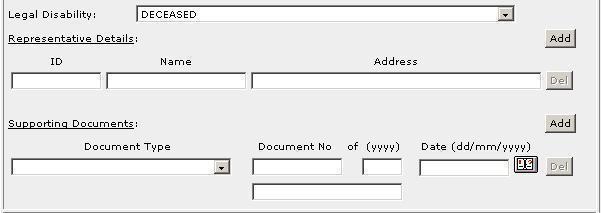

| 3. |

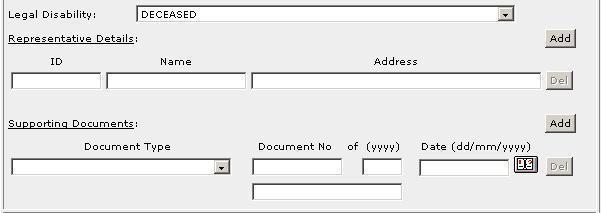

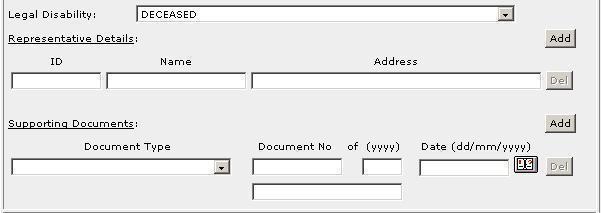

To indicate legal disability:

If you wish to indicate that a party is under a Legal Disability [D],

you may select from the list provided. You may then enter the details

of the representative and supporting documents in the text boxes provided.

To add more representatives or supporting documents click on Add [B]

next to the respective headers. You may add up to 5 records each. Click

on Del [B] to remove any redundant rows.

|

| 4. |

Click on Add [B]. Repeat the previous steps

to add more records. |

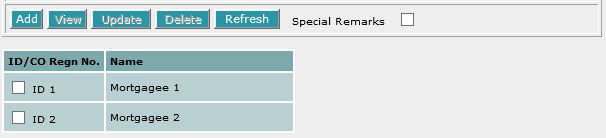

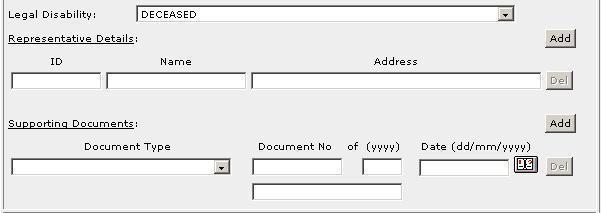

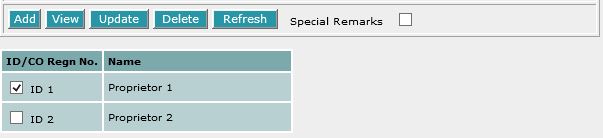

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

Note:

Information entered in this section will be used for the generation of the EXECUTION

BY MORTGAGEE and the CERTIFICATE

OF CORRECTNESS where applicable.

Back to Forms

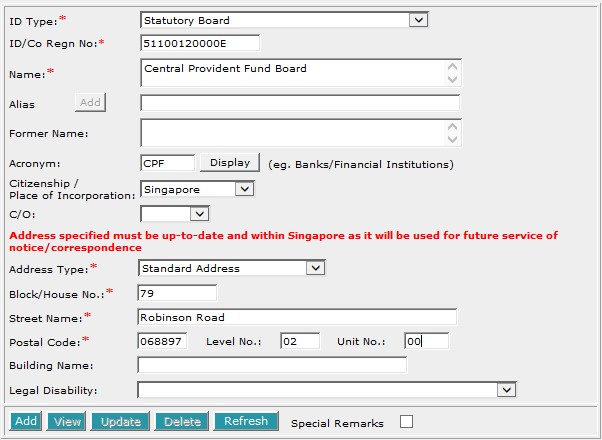

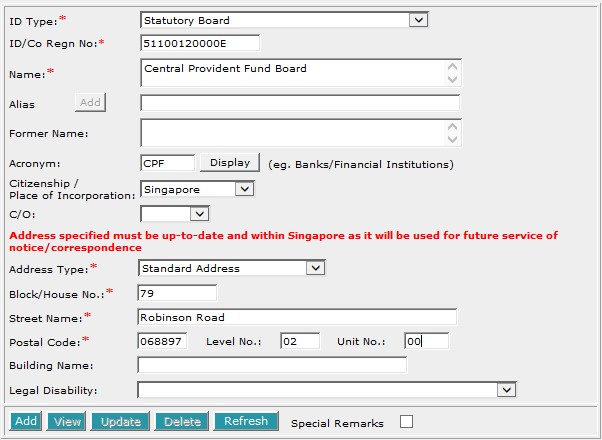

This section allows you to enter the details of the above parties. By default, this will be set as Central Provident Fund Board.

The compulsory data items are indicated by an * marked in red.

To create a record:

| 1. |

Enter the data. For example, ID/Co Regn No. [T], Name

[S], Block/House No.[T], Street Name [T] and Postal

Code [T].

|

| 2. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen.

|

Special Remarks

Note:

Information entered in this section will be used for the generation of the CERTIFICATE OF CORRECTNESS

where applicable.

Back to Forms

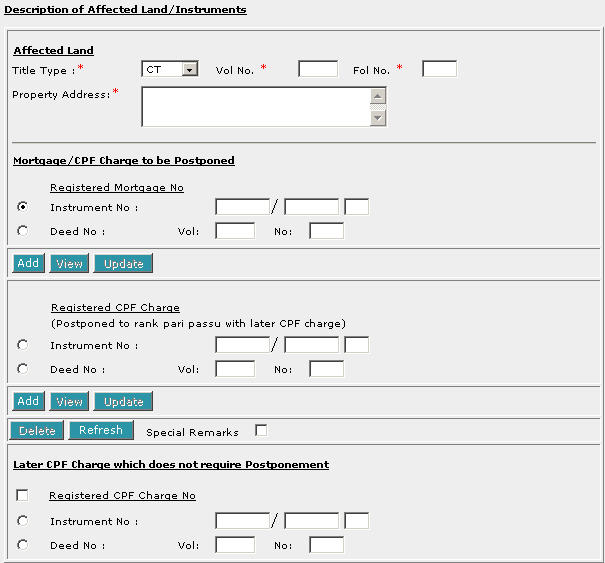

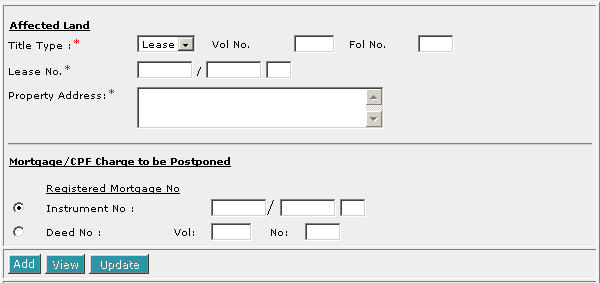

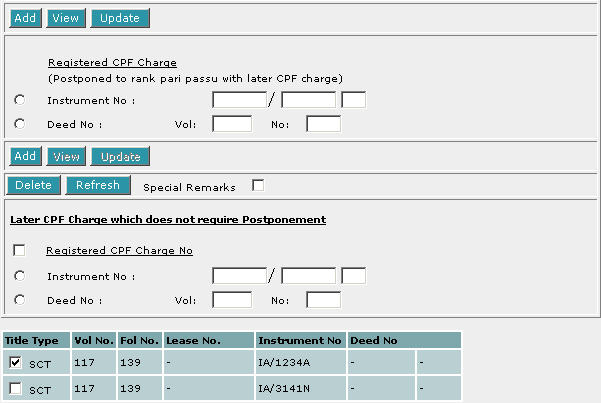

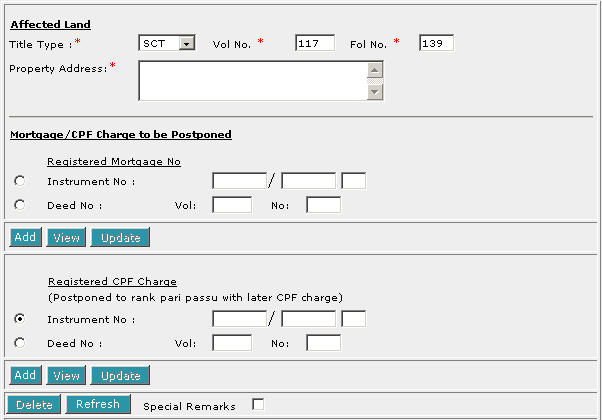

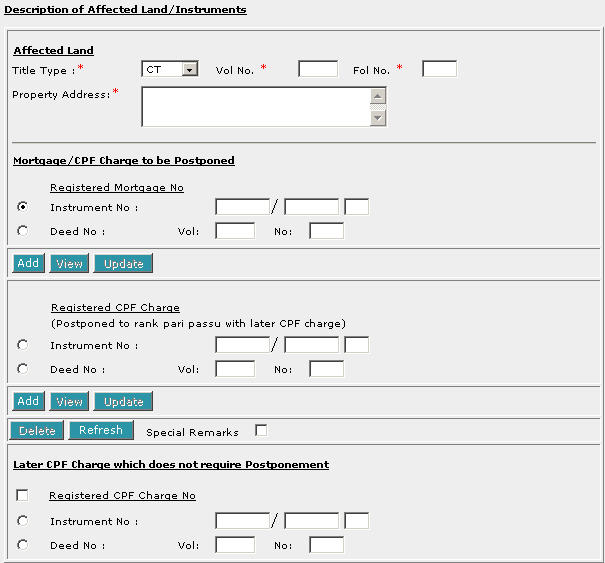

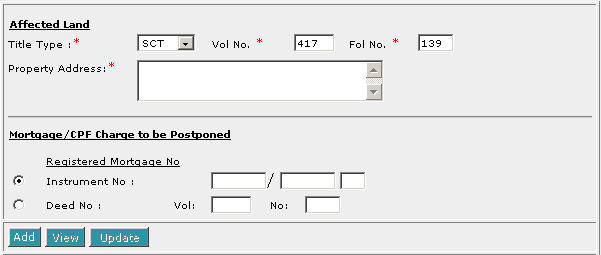

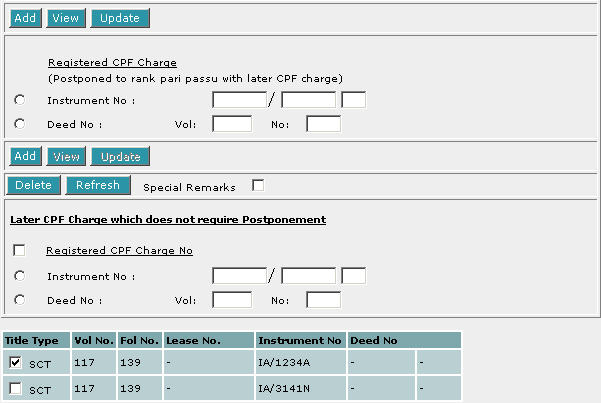

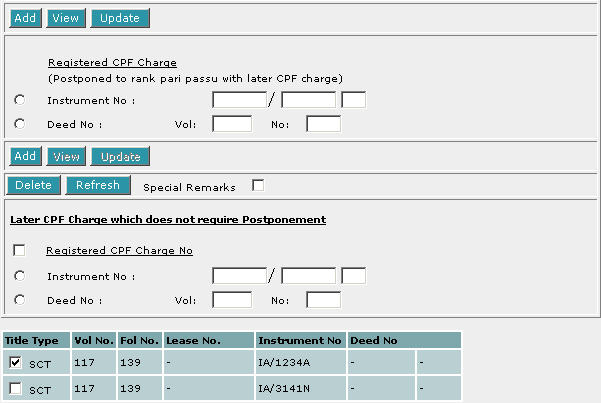

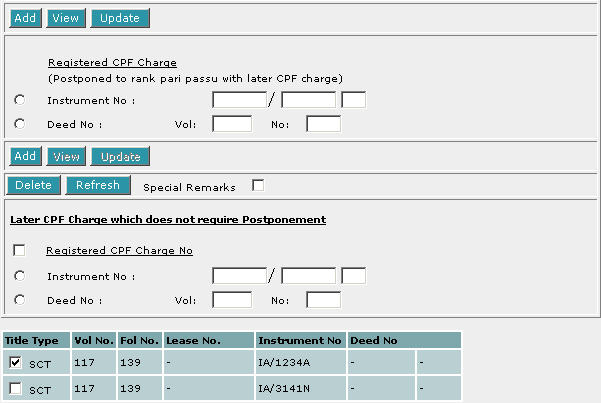

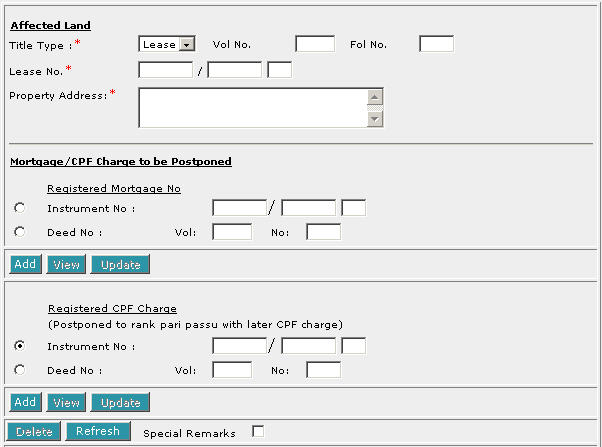

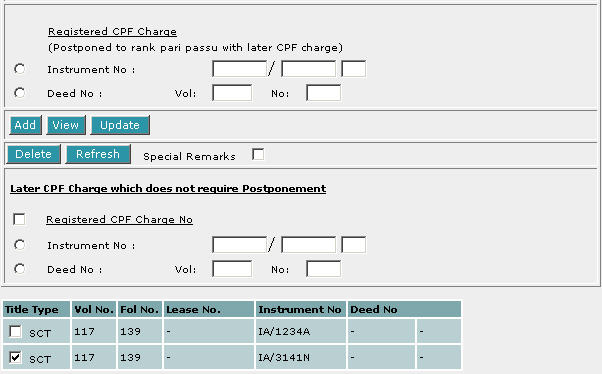

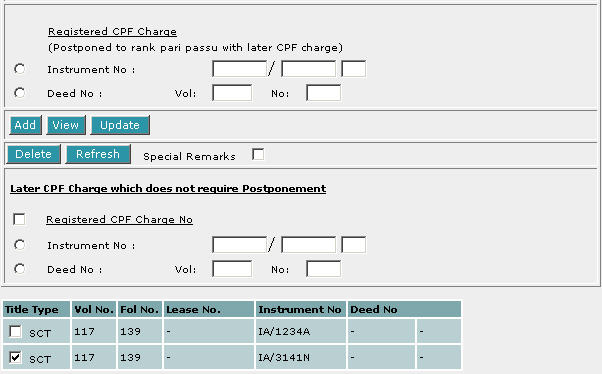

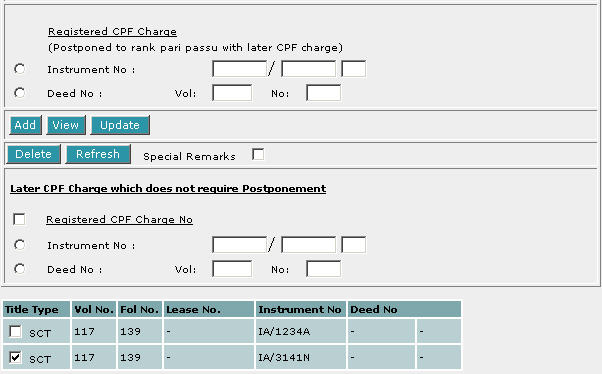

| DESCRIPTION OF MORTGAGE/CHARGE TO BE POSTPONED |

This section allows you to enter the description of mortgage/CPF charge to be

postponed, registered CPF charge and later CPF charge which does not require

postponement. You have to enter data in Mortgage/CPF Charge to be Postponed and Later CPF Charge.

Enter data in Registered CPF Charge to rank pari passu with later CPF Charge.

If 1 or no Registered CPF Charge is added, Data entered in those fields will be reflected in Order of Priority in the PROVISIONS section.

If more than 1 Registered CPF Charge is added, only Other Provisions [R] in the PROVISIONS section

can be selected.

The compulsory data items are indicated by an * marked in red.

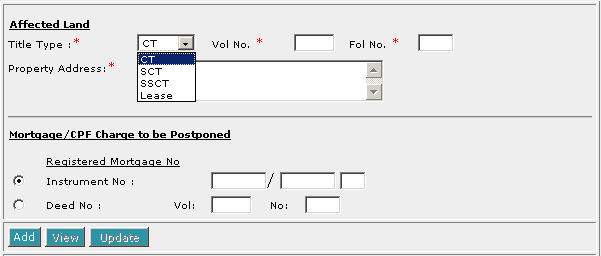

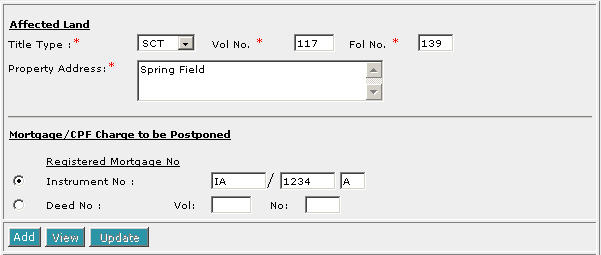

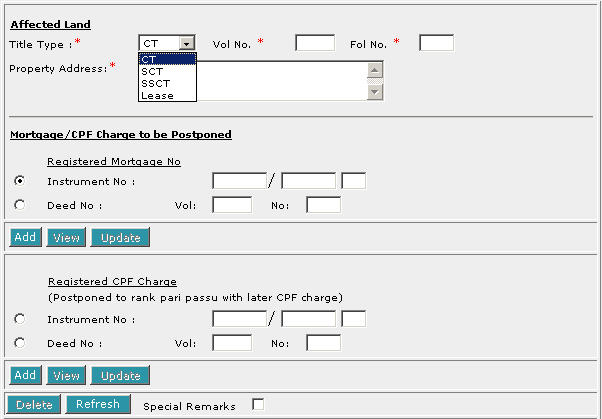

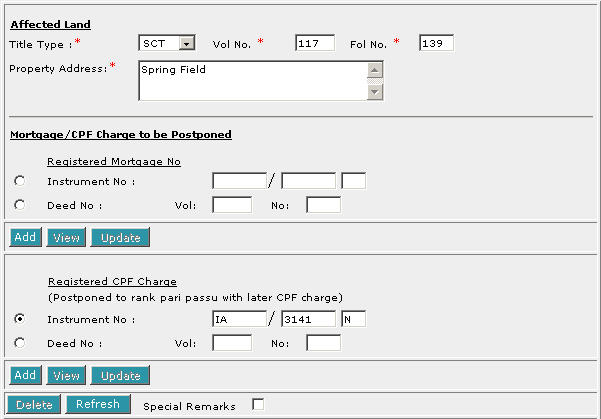

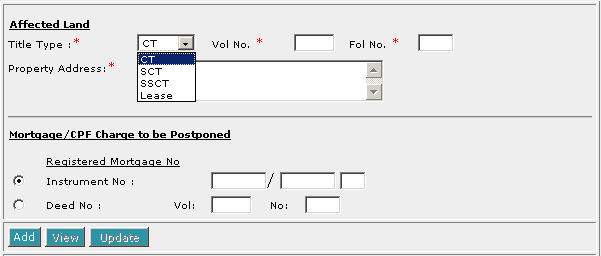

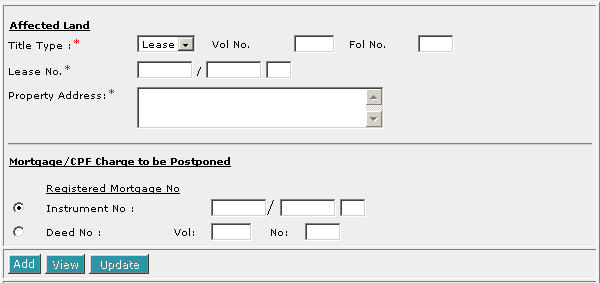

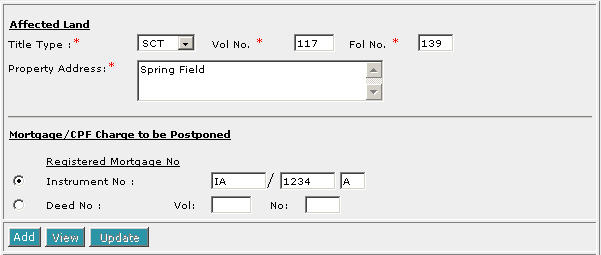

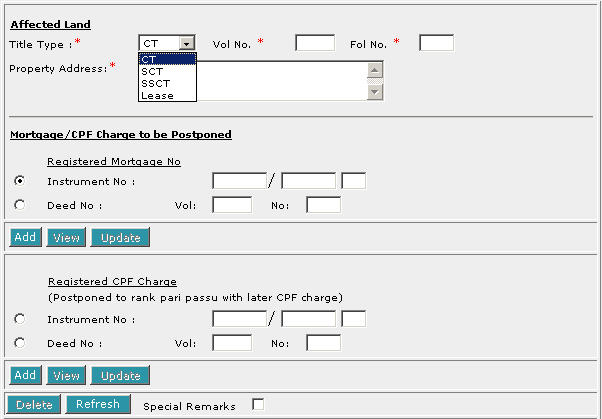

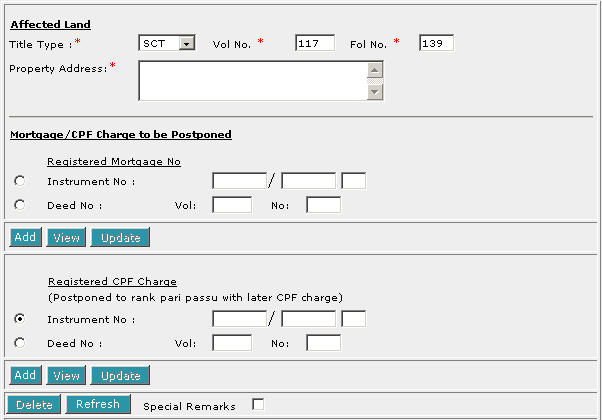

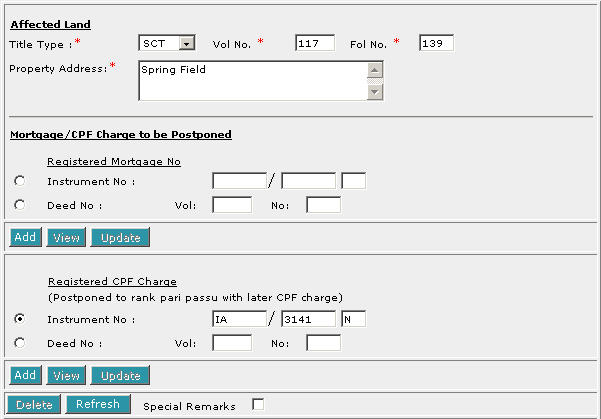

To create a record for description of mortgage/CPF charge to be postponed:

| 1. |

Select the Title Type [D].

|

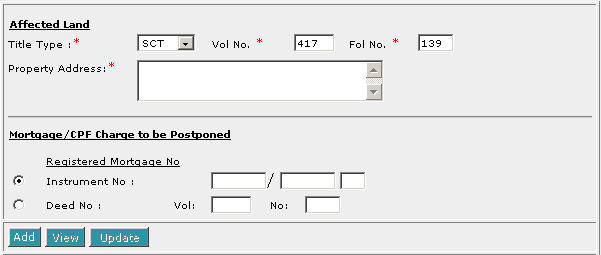

| 2. |

If CT (Certificate of Title), SCT (Subsidiary

Certificate of Title) or SSCT (Subsidiary Strata Certificate

of Title) is selected, enter Vol No [T] and Fol No [T].

If Lease is selected, enter the Lease No [T].

|

| 3. |

Enter Property Address [T]. |

| 4. |

Select Instrument No [R] or Deed No [R]. There

must be at least one Registered Mortgage No. |

| 5. |

If you have selected Instrument No [R], enter the Instrument

No [T]. If you have selected Deed No [R], enter Vol

[T] and No [T]. However, if you are not in a position to enter the instrument no or deed no at the time of preparation of the form,

you may enter the instrument no or deed no prior to submission for lodgment. You will be given a reminder message "Please ensure Registered Mortgage No is entered before submission.

Click [OK] to proceed or [Cancel] to enter now".

|

| 6. |

Click on Add [B]. Repeat the previous steps to add

more records. |

To view a record for description of mortgage/CPF charge to be postponed:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record for description of mortgage/CPF charge to be postponed:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record for description of mortgage/CPF charge to be postponed:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen for description of mortgage/CPF charge to be

postponed:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

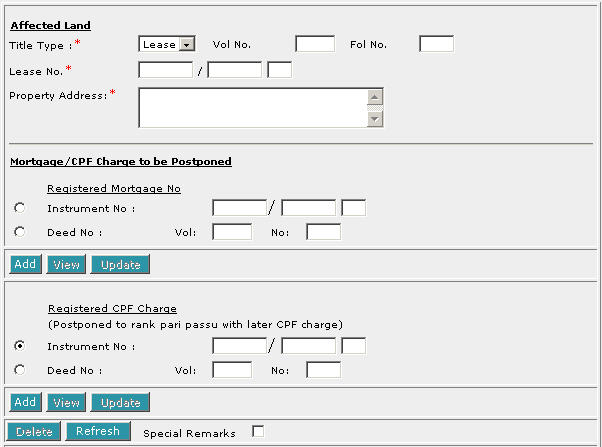

To create a record for Registered CPF Charge (Postponed to rank pari passu with later CPF charge):

| 1. |

Select the Title Type [D].

|

| 2. |

If CT (Certificate of Title), SCT (Subsidiary

Certificate of Title) or SSCT (Subsidiary Strata Certificate

of Title) is selected, enter Vol No [T] and Fol No [T].

If Lease is selected, enter the Lease No [T].

|

| 3. |

Enter Property Address [T]. |

| 4. |

Select Instrument No [R] or Deed No [R].

|

| 5. |

If you have selected Instrument No [R], enter the Instrument

No [T]. If you have selected Deed No [R], enter Vol

[T] and No [T]. However, if you are not in a position to enter the instrument no or deed no at the time of preparation of the form,

you may enter the instrument no or deed no prior to submission for lodgment. You will be given a reminder message "Please ensure Registered

Charge No is entered before submission.

Click [OK] to proceed or [Cancel] to enter now".

|

| 6. |

Click on Add [B]. Repeat the previous steps to add

more records. |

To view a record for Registered CPF Charge (Postponed to rank pari passu with later CPF charge):

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record for Registered CPF Charge (Postponed to rank pari passu with later CPF charge):

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record for Registered CPF Charge (Postponed to rank pari passu with later CPF charge):

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen for Registered CPF Charge (Postponed to rank pari passu with later CPF charge):

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

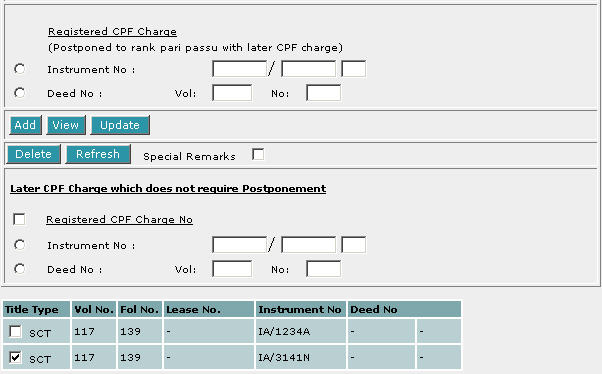

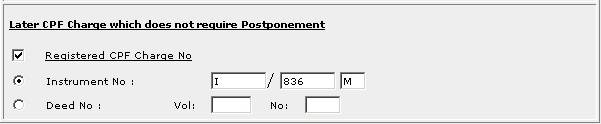

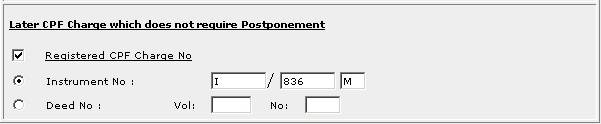

To enter Later CPF Charge:

| 1. |

Select the check box of Registered CPF Charge No [C].

|

| 2. |

Select Instrument No [R] or Deed No [R].

If you have selected Instrument No [R], enter the Instrument

No [T].

If you have selected Deed No [R], enter Vol

[T] and No [T].

However, if you are not in a position to enter the instrument no or deed no at the time of preparation of the form,

you may enter the instrument no or deed no prior to submission for lodgment. You will be given a reminder message "Please ensure Later Charge No is entered before submission.

Click [OK] to proceed or [Cancel] to enter now".

|

Special Remarks

Information entered in this section will be used for the generation of

Standard Clauses of PROVISIONS where

applicable.

Back to Forms

This section allows you to enter the details of the above parties. The compulsory

data items are indicated by an * marked in red.

To create a record:

| 1. |

Enter the data. For example, ID/Co Regn No. [T], Name

[S], Block/House No.[T], Street Name [T] and Postal

Code [T].

|

| 2. |

To enter alias(es):

You may enter the aliases in the text box provided. To add more Aliases,

click on Add [B] and enter the name in the text box provided. Repeat

the previous steps to add more records. You may enter up to 5 aliases.

Empty alias fields will automatically be deleted when the screen is refreshed.

|

| 3. |

To indicate legal disability:

If you wish to indicate that a party is under a Legal Disability [D],

you may select from the list provided. You may then enter the details

of the representative and supporting documents in the text boxes provided.

To add more representatives or supporting documents click on Add [B]

next to the respective headers. You may add up to 5 records each. Click

on Del [B] to remove any redundant rows.

|

| 4. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen.

|

Special Remarks

Note:

Information entered in this section will be used for the generation of the EXECUTION

BY REGISTERED PROPRIETOR where applicable.

Back to Forms

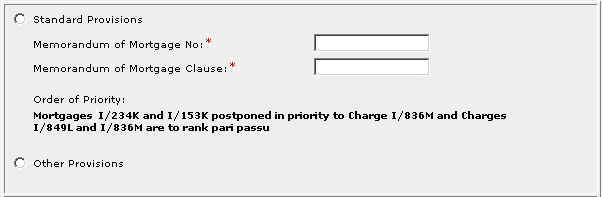

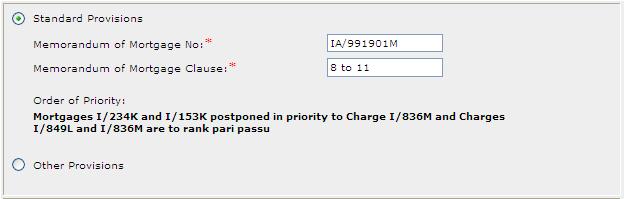

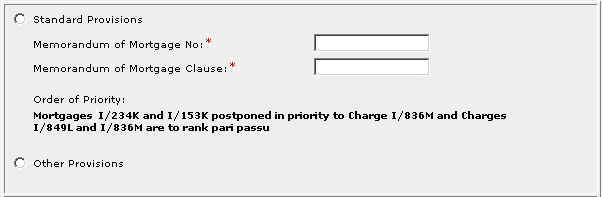

This section is dependent on the information entered in the DESCRIPTION OF MORTGAGE/CHARGE TO BE POSTPONED

section.

If more than 1 Registered Charge is added in DESCRIPTION OF MORTGAGE/CHARGE TO BE POSTPONED

section, only Other Provisions [R] can be selected.

This section allows you to enter details of provisions. The compulsory

data items are indicated by an * marked in red.

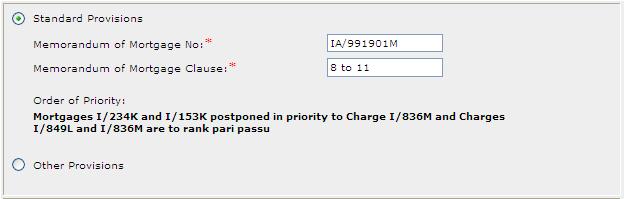

| 1. |

Select Standard Provisions [R] or Other Provisions [R].

|

| 2. |

When Standard Provisions [R] is selected:

Enter Memorandum of Mortgage No [T], Memorandum of Mortgage

Clause [T]. The Memorandum of Mortgage No [T] and

the Memorandum of Mortgage

Clause [T] are defaulted to IA/991901M and 8 to

11 respectively each time you

enter the screen. However, you may change the data if necessary.

|

| 3. |

When Other Provisions [R] is selected:

Enter data in the free text area as provided.

|

Special Remarks

Back to Forms

Enter the Date of Instrument [T].

This is a compulsory data item as indicated by an *

marked in red. However, if you are not in a position

to enter the date at the time of preparation of the form, you may enter the

date prior to submission for lodgment. You will be given a reminder message "Please ensure Date is entered before submission.

Click [OK] to proceed or [Cancel] to enter now"

Back to Forms

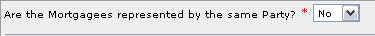

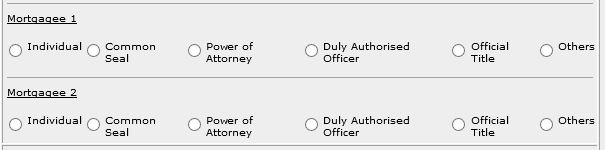

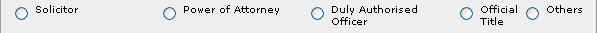

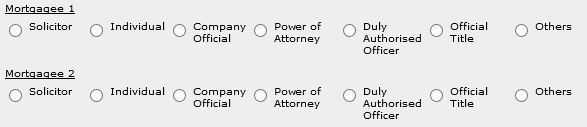

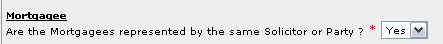

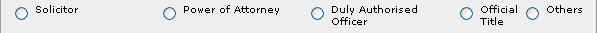

| EXECUTION

BY DEFERRED MORTGAGEE |

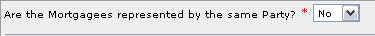

This section is dependent on the information entered in the MORTGAGEE

section.

If there is only one mortgagee entered in previous section, you will be prompted:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

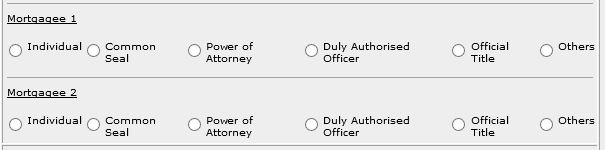

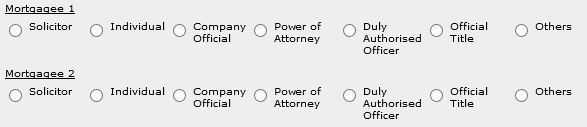

If there are more than one mortgagee entered in previous section, you will

be prompted:

Select Yes or No.

If you have selected Yes:

| 1. |

Select the appropriate mode of execution. |

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

If you have selected No:

For each mortgagee:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

Special Remarks

Back to Forms

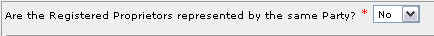

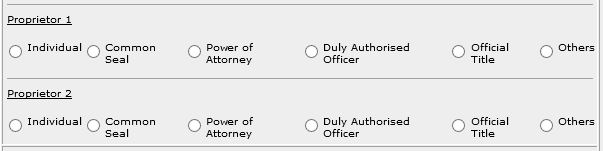

| EXECUTION

BY REGISTERED PROPRIETOR |

This section is dependent on the information entered in the REGISTERED

PROPRIETOR

section.

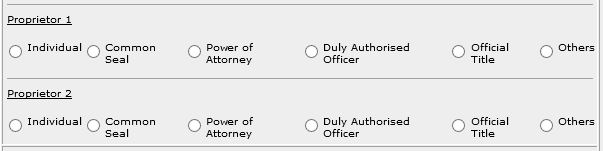

If there is only one registered proprietor entered in previous section, you will be prompted:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

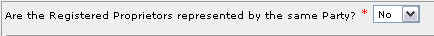

If there are more than one registered proprietor entered in previous section, you will

be prompted:

Select Yes or No.

If you have selected Yes:

| 1. |

Select the appropriate mode of execution. |

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

If you have selected No:

For each registered proprietor:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

Special Remarks

Back to Forms

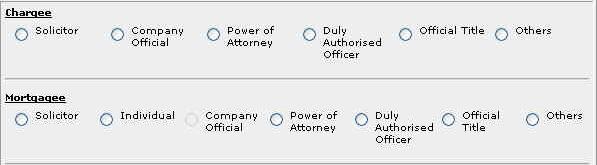

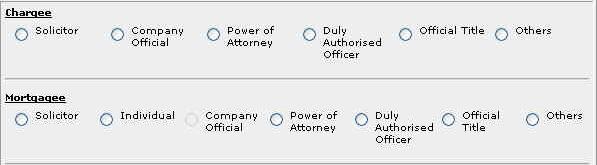

| CERTIFICATE

OF CORRECTNESS |

This section is dependent on the information entered in the MORTGAGEE

and CHARGEE sections.

If there is only one party entered in previous section, you will be prompted:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please

see Modes of

Execution for Certificate of Correctness for details. |

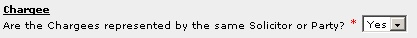

If there are more than one chargee/mortgagee entered in previous section, you will be prompted:

Select Yes or No.

If you have selected Yes:

If you have selected No:

For each chargee/mortgagee:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please

see Modes of

Execution for Certificate of Correctness for details. |

Special Remarks

Back to Forms

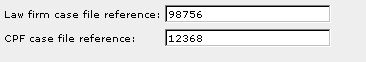

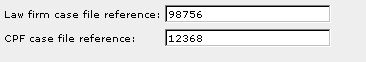

This optional section allows you to enter your case file reference or the CPF

case file reference.

| 1. |

Enter the Law firm case file reference [T] if necessary. |

| 2. |

Enter the CPF case file reference [T] if necessary. |

Back to Forms