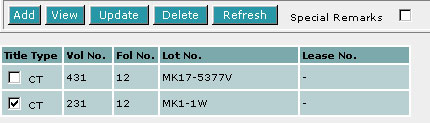

This section allows you to enter the description of land.

The compulsory data items are indicated by an *

marked in red.

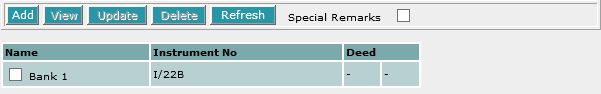

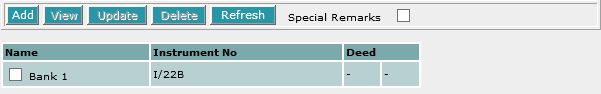

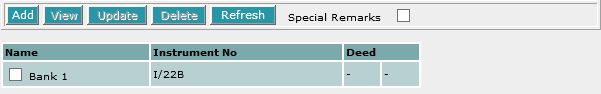

To create a record:

| 1. |

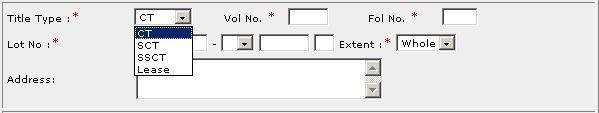

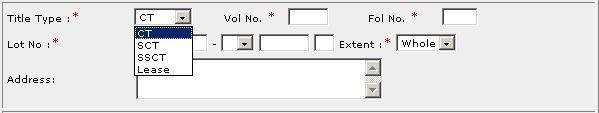

Select the Title Type [D].

|

| 2. |

If CT (Certificate of Title), SCT (Subsidiary

Certificate of Title) or SSCT (Subsidiary Strata Certificate

of Title) is selected, enter the Vol No [T] and Fol No

[T].

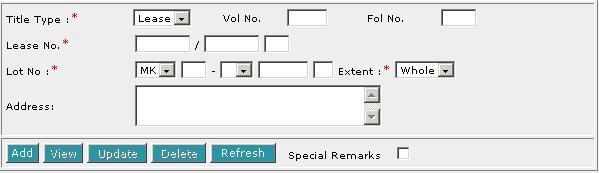

If Lease is selected, enter the Lease No. [T].

|

| 3. |

Select the MK (Mukim) or TS (Town

Subdivision) and enter the rest of the Lot No. [D, T]. |

| 4. |

Enter the Address [S]. |

| 5. |

Click on Add [B]. Repeat the previous steps to add

more records. |

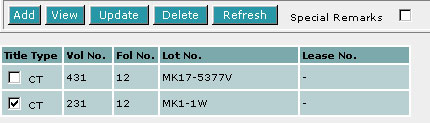

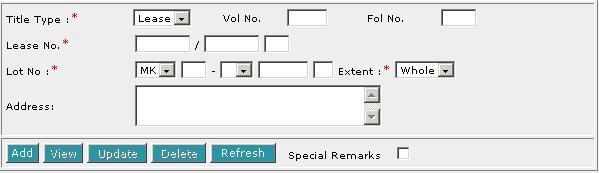

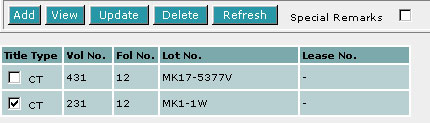

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

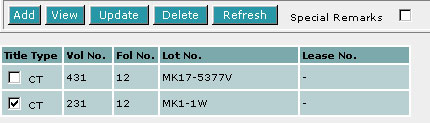

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

If you selected Part in the Extent field, then PLOT/UNIT

AND CHILD LOT DETAILS section must be filled in.

Back to Forms

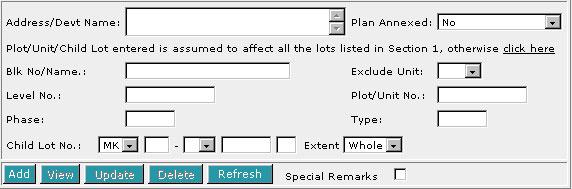

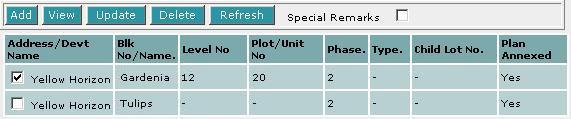

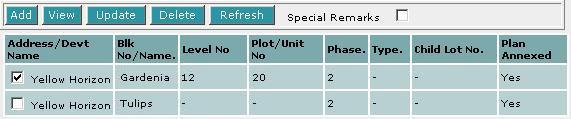

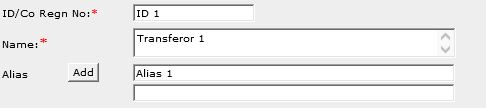

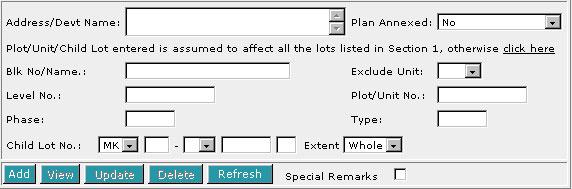

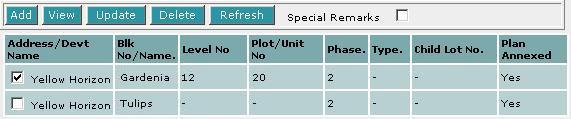

| PLOT/UNIT

AND CHILD LOT DETAILS |

This section is compulsory if the Extent field is selected as Part

in the DESCRIPTION OF LAND section.

To create a record:

| 1. |

Enter the data as required. If you enter both the particulars of the Unit

as well as the Child lot number within the same screen, it is assumed

that both refer to the same property.

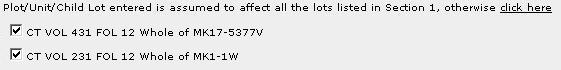

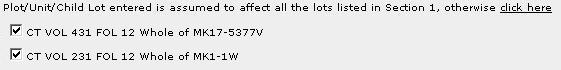

The Plot/Unit/Child Lot entered is assumed to affect all the lots listed

in DESCRIPTION OF LAND section. If

this is not the case and you wish to specify a particular lot, then click

on "click here" [H]. The screen will display all

the lots from the DESCRIPTION OF LAND

section. Select the lot that is relevant to your Plot/Unit/Child Lot.

|

| 2. |

Click on Add [B]. Repeat the previous steps to add

more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted. |

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen.

|

Special Remarks

Back to Forms

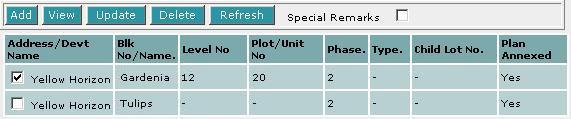

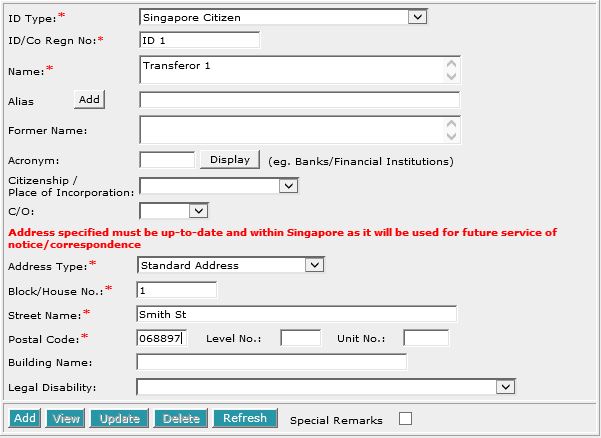

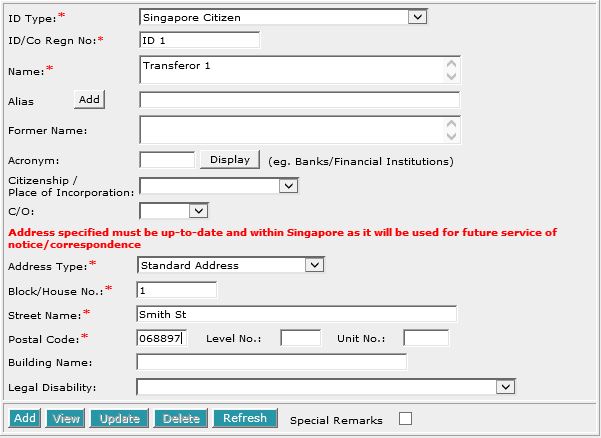

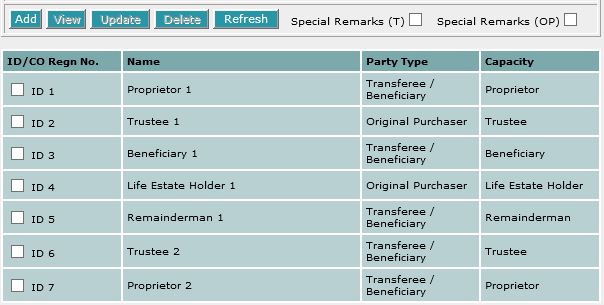

This section allows you to enter the details of the above parties. The compulsory

data items are indicated by the * marked in red.

To create a record:

| 1. |

Enter the data. For example, ID/Co Regn No. [T], Name [S],

Block/House No.[T], Street Name [T] and Postal Code [T].

|

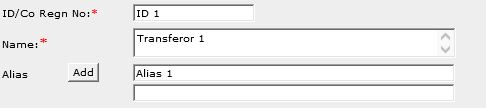

| 2. |

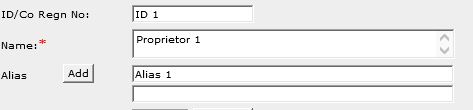

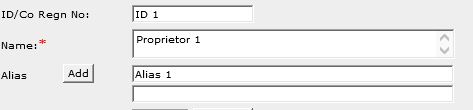

To enter alias(es):

You may enter the aliases in the text box provided. To add more Aliases,

click on Add [B] and enter the name in the text box provided. Repeat

the previous steps to add more records. You may enter up to 5 aliases.

Empty alias fields will automatically be deleted when the screen is refreshed.

|

| 3. |

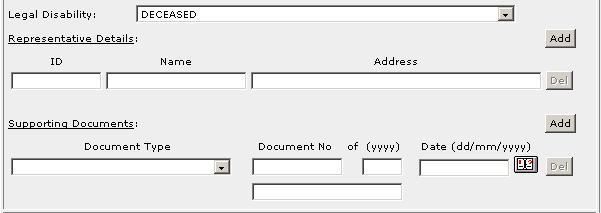

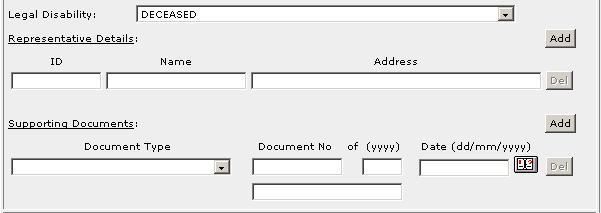

To indicate legal disability:

If you wish to indicate that a party is under a Legal Disability [D],

you may select from the list provided. You may then enter the details

of the representative and supporting documents in the text boxes provided.

To add more representatives or supporting documents click on Add [B]

next to the respective headers. You may add up to 5 records each. Click

on Del [B] to remove any redundant rows.

|

| 4. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

Note:

Information entered in this section will be used for the generation of the EXECUTION

BY TRANSFEROR and CERTIFICATE

OF CORRECTNESS.

Back to Forms

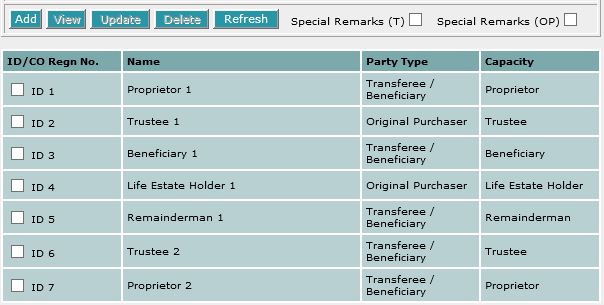

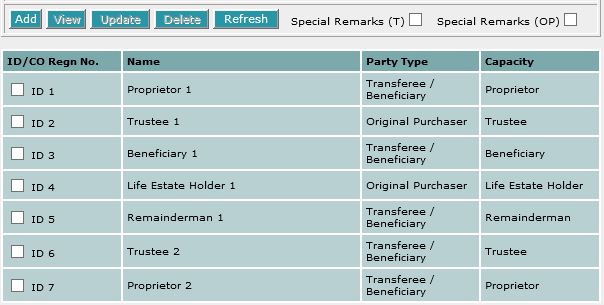

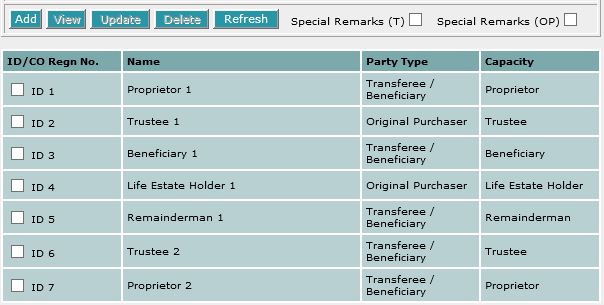

| TRANSFEREE / BENEFICIARY /

ORIGINAL

PURCHASER |

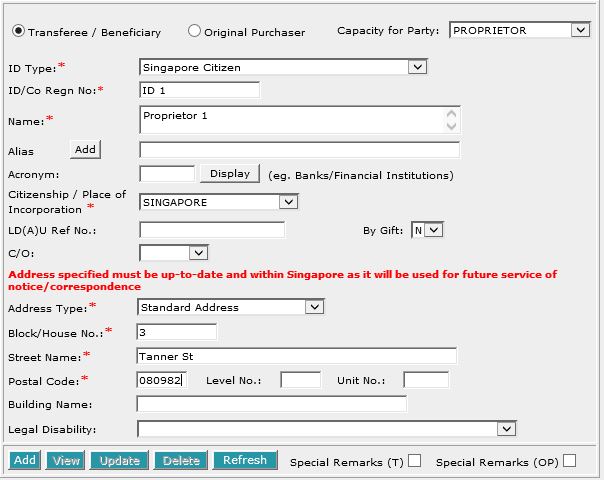

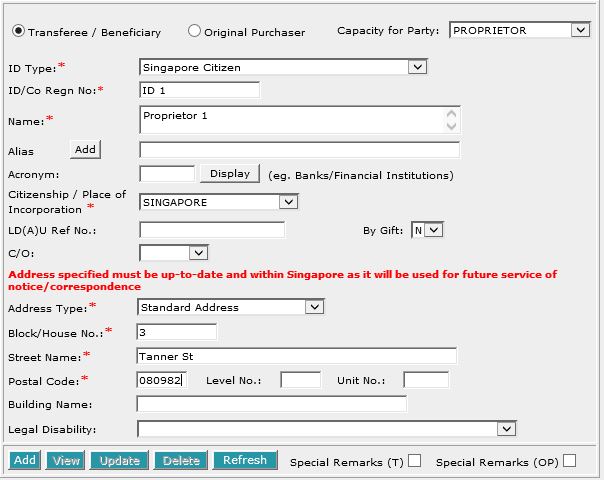

This section allows you to enter the details of the above parties. The compulsory

data items are indicated by the * marked in red.

To create a record:

| 1. |

Select either Transferee / Beneficiary [R] or Original Purchaser [R],

select Capacity for Party [D] and enter the data. For example, ID/Co Regn No. [T], Name [S],

Block/House No.[T], Street Name [T] and Postal Code [T].

|

| 2. |

To enter alias(es):

You may enter the aliases in the text box provided. To add more Aliases,

click on Add [B] and enter the name in the text box provided. Repeat

the previous steps to add more records. You may enter up to 5 aliases.

Empty alias fields will automatically be deleted when the screen is refreshed.

|

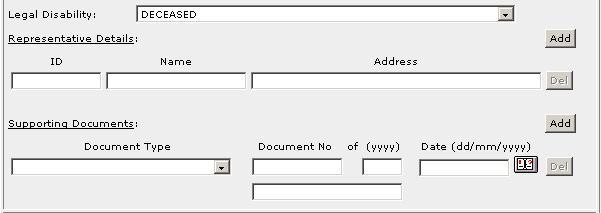

| 3. |

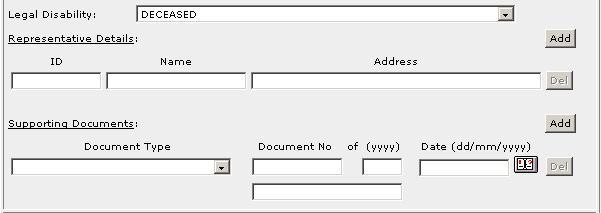

To indicate legal disability:

If you wish to indicate that a party is under a Legal Disability [D],

you may select from the list provided. You may then enter the details

of the representative and supporting documents in the text boxes provided.

To add more representatives or supporting documents click on Add [B]

next to the respective headers. You may add up to 5 records each. Click

on Del [B] to remove any redundant rows.

|

| 4. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

Note:

There are two special remarks for this form. One for Transferee /

Beneficiary (T)

and one for Original Purchaser (OP).

Information entered in this section will be used for the generation of the EXECUTION

BY TRANSFEREE / ORIGINAL PURCHASER, CERTIFICATE

OF CORRECTNESS and CERTIFICATE PURSUANT TO THE RESIDENTIAL PROPERTY ACT AND LAND TITLES RULES.

Back to Forms

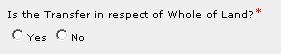

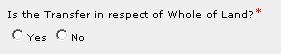

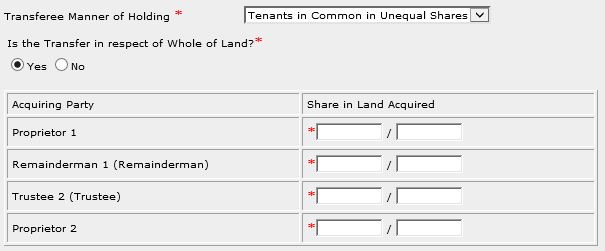

| SHARE IN LAND

AFFECTED / MANNER OF HOLDING |

The section allows you to enter the Manner of Holding of the Transferees.

This section is dependent on the information entered in the TRANSFEROR

and TRANSFEREE / BENEFICIARY / ORIGINAL PURCHASER sections.

You will need to specify if the transfer is in respect of Whole of Land.

| 1. |

Select Yes or No to the question above.

|

| 2. |

If you have selected Yes, proceed to enter the Manner

of Holding for the Transferee.

|

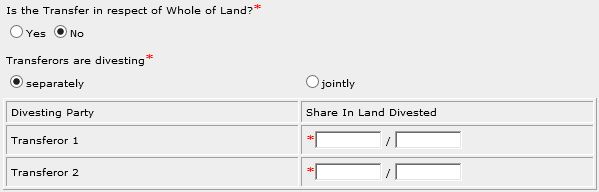

| 3. |

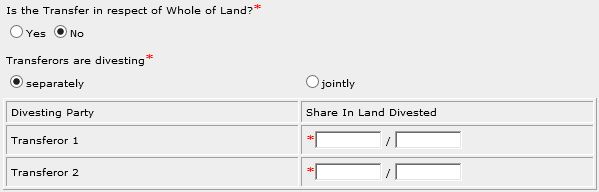

If you have selected No, specify if the transferors are

divesting their interest separately [R] or jointly [R].

| - |

select separately [R] if the transferors

are divesting the respective shares of the individual Registered

Proprietors. Proceed to step 4. |

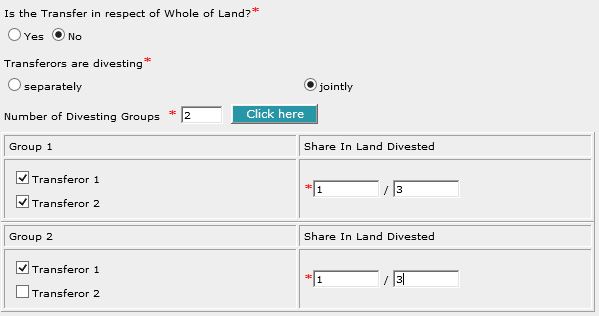

| - |

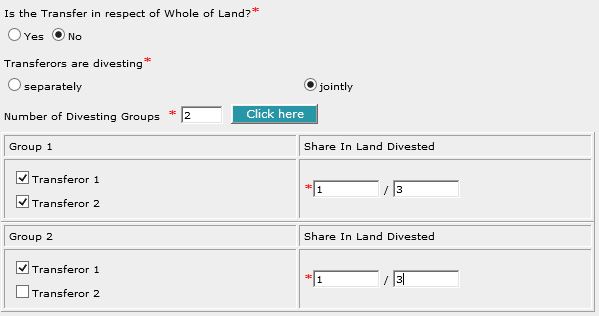

select jointly [R] if the transferors are

divesting their interest jointly. Proceed to step 5. |

|

| 4. |

If the land is divested separately, enter the Share In Land Divested

[T] as absolute share in the whole land.

|

| 5. |

If the land is divested jointly, enter the Number of Divesting Group

[T]. System will retrieve all the names entered in the TRANSFEROR

sections

and display them in as many groups as you have indicated. For each

group, select the relevant party or parties and indicate the Share in

Land Divested [T].

For example, Gwendolyn Ho and George Ho are divesting as joint

tenants of 1/3 share in land. In addition, Gwendolyn Ho is divesting

party of another 1/3 share in land. As such, there

are 2 divesting groups. Therefore, enter "2" in the Number

of Divesting Groups [T]. Click on the command button next to it and

enter the data as required.

|

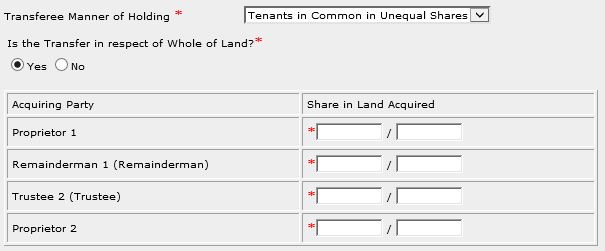

You will need to specify the Manner of Holding of the Transferee:

If it is a standard Manner of Holding, you can select from the drop down list

provided. If you have selected Joint Tenants or Tenants in

Common in Equal Shares, no further entries are required.

If you have selected Tenants in

Common in Unequal Shares for the Transferee Manner of Holding [D]:

Enter the Share in Land Acquired [T] against each Transferee.

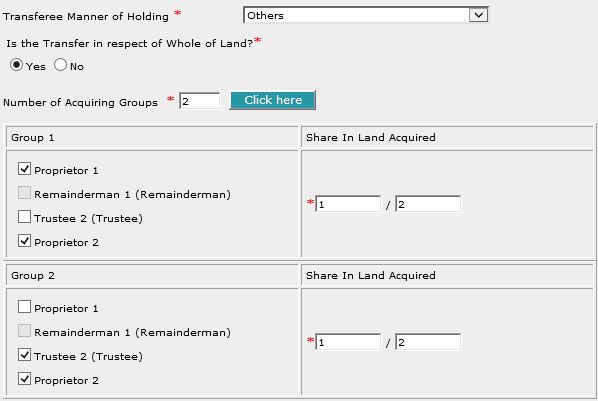

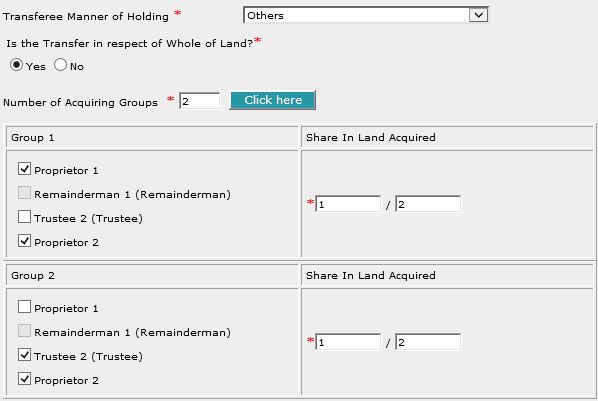

If you have selected Others for the Transferee Manner of Holding [D]:

Enter the Number of Acquiring Groups [T].

The system will retrieve all the names entered in the Transferee's

section and display them in as many groups as you have indicated. For each group, select the relevant party or

parties and indicate the Share in Land Acquired [T].

For example, Felix Ling and Helen Ho are to acquire 1/2 share in land

as joint tenants. In addition, Terrence Ho and Helen Ho are to acquire

another 1/2 share in land

as joint tenants. As such, there are 2 acquiring groups. Therefore, enter

"2" in the Number of Acquiring Groups [T]. Click on the command

button next to it and enter the data as required.

For certain cases, for example, there are more than one beneficiary, a free

text box will be provided for you to enter the Manner of Holding:

Special Remarks

Back to Forms

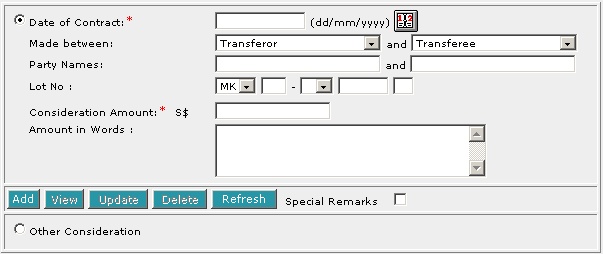

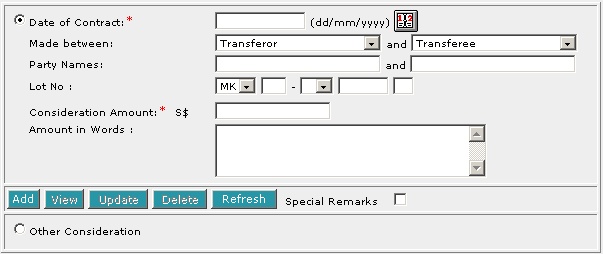

This section allows you to enter the considerations made in the

Transfer.

To create a record:

| 1. |

Enter the Date of Contract [T], and Consideration Amount [T].

The consideration amount will be reflected in words.

|

| 2. |

You may enter Party Names [T] and Lot No [T]

if you wish to enter the different units sold at

different prices to various parties. |

| 3. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necesssary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

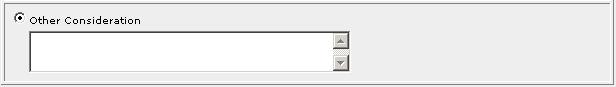

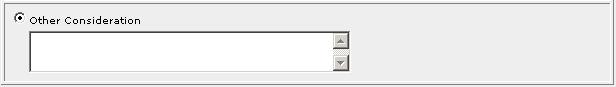

When Other Consideration is selected:

| 1. |

Enter data in the free

text area as provided. |

Special Remarks

Back to Forms

This section allows you to enter the prior encumbrances. The text area is

defaulted to Nil. You may change it if necessary.

Back to Forms

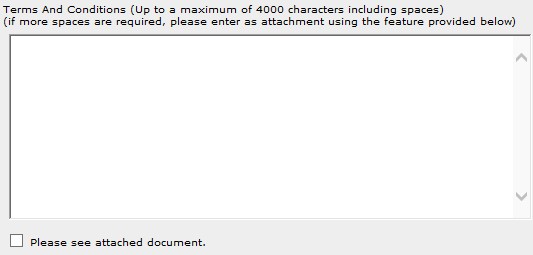

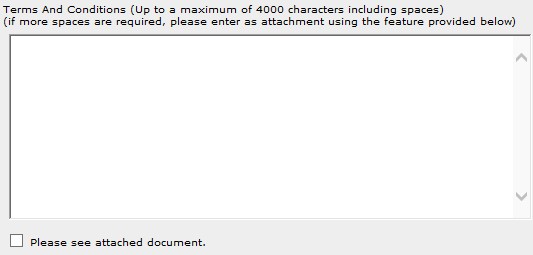

| TERMS, COVENANTS AND CONDITIONS |

This section allows you to enter the terms, covenants and conditions.

You may enter the Terms and Conditions [S] up to a maximum of 4000 characters

including spaces (estimated to be about 500 words) in the text area provided.

If the Terms and Conditions [S] requires more than 4000 characters (ie.

slightly more than half-page), you will need to write it in a separate document.

If you have a document to attach to the form, select the check box for "Please see attached document".

Back to Forms

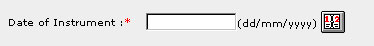

Enter the Date of Instrument [T].

This is a compulsory data item as indicated by an *

marked in red. However, if you are not in a position

to enter the date at the time of preparation of the form, you may enter the

date prior to submission for lodgment. You will be given a reminder message "Please ensure Date is entered before submission.

Click [OK] to proceed or [Cancel] to enter now"

Back to Forms

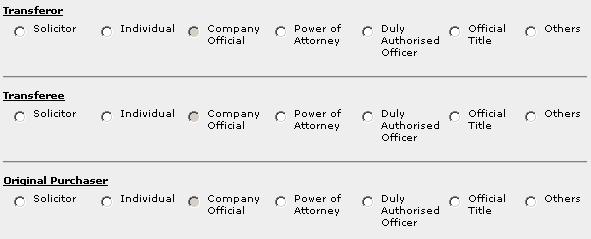

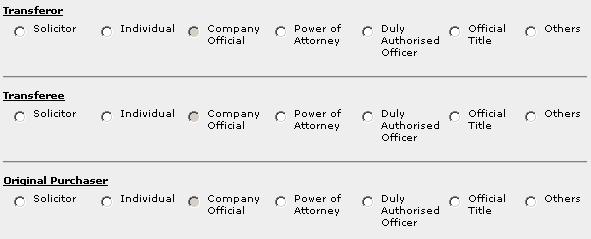

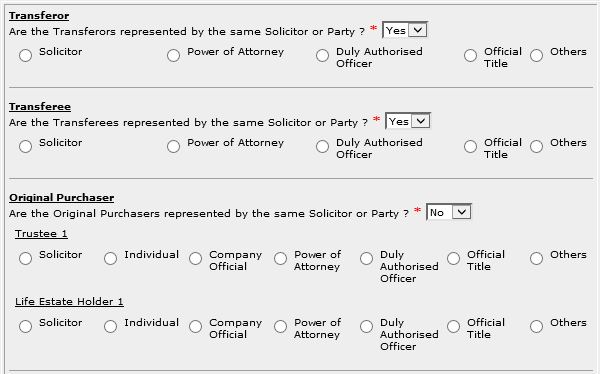

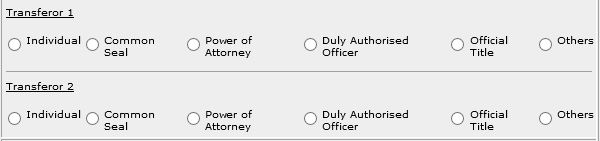

This section is dependent on the information entered in the TRANSFEROR

section.

If there is only one transferor entered in previous section, you will be prompted:

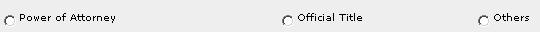

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

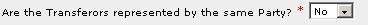

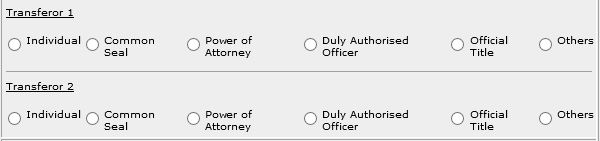

If there are more than one transferor entered in previous section, you will be

prompted:

Select Yes or No.

If you have selected Yes:

| 1. |

Select the appropriate mode of execution. |

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

If you have selected No:

For each transferor:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

Special Remarks

Back to Forms

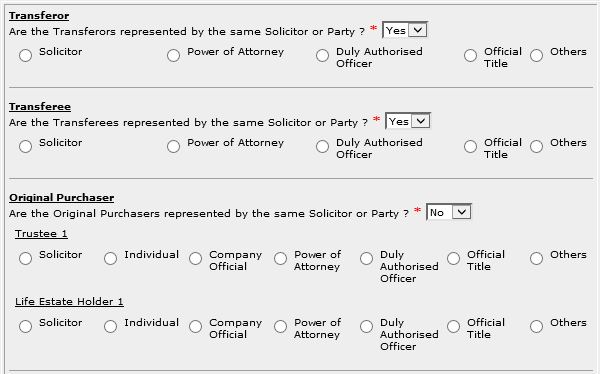

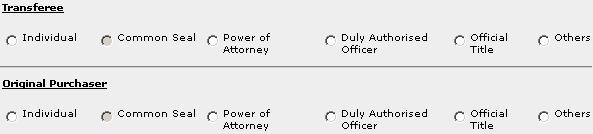

| EXECUTION BY

TRANSFEREE / ORIGINAL PURCHASER

|

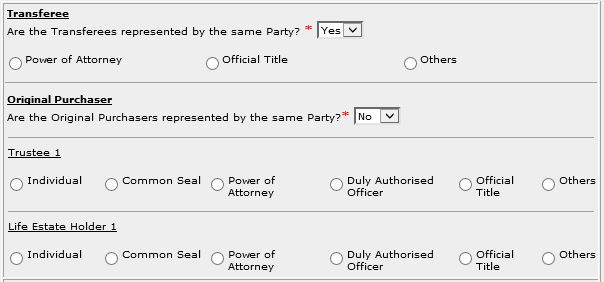

This section is dependent on the information entered in the TRANSFEREE

/ BENEFICIARY / ORIGINAL PURCHASER

section.

If there is only one transferee/original purchaser entered in previous

section, you will be prompted:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

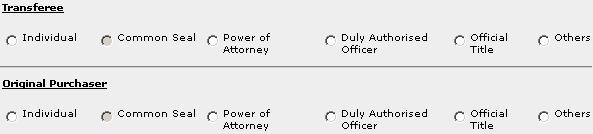

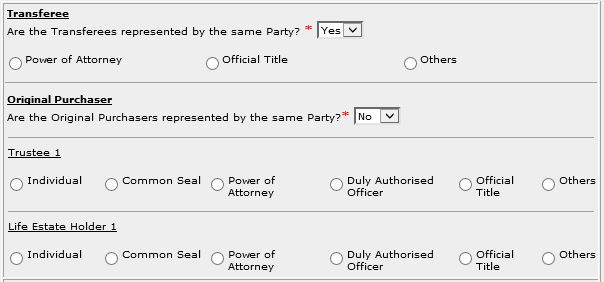

If there are more than one transferee / original purchaser entered in previous section, you will be

prompted:

Select Yes or No. The example above shows the modes of execution

that are available if Yes is selected and if No is selected.

For each transferee/original purchaser:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the

Execution Clause will be generated automatically. Please see Modes

of Execution for details. |

Special Remarks

Back to Forms

| CERTIFICATE

PURSUANT TO THE RESIDENTIAL PROPERTY ACT AND LAND TITLES RULES |

This section allows you to enter the Certificates pursuant to the

requirements of the Residential Property Act and Land Titles Rules. You are only

required to enter the name of the solicitor who is acting in the matter. You may

prepare Certificate verifying ID/Passport No and Citizenship/Place of

Incorporation, Certificates pursuant to the Residential Property Act, and

Statutory Declarations pursuant to Clearance Certificate, in this section. This section is

dependent on the information entered in the TRANSFEREE /

BENEFICIARY / ORIGINAL PURCHASER section. The compulsory

data items are indicated by the * marked in red.

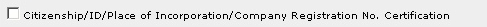

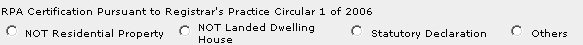

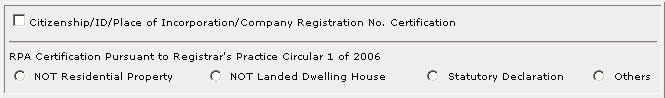

For Certification of the ID/Passport No and Citizenship/Place of Incorporation of

acquiring party, select the below:

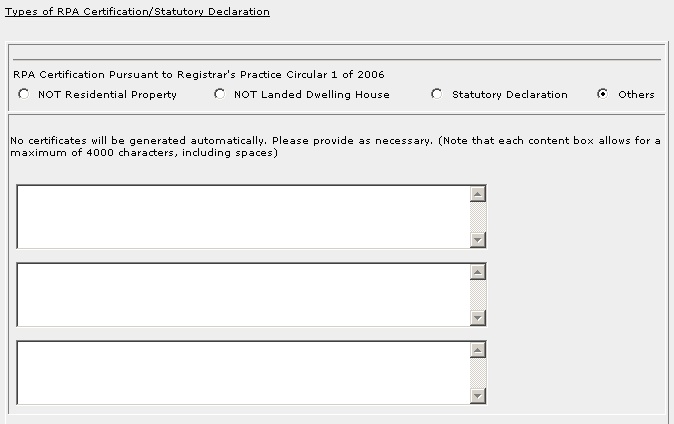

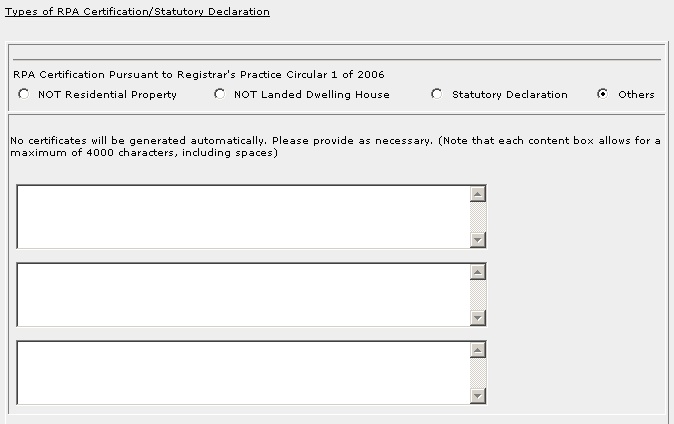

For RPA Certification Pursuant to Registrar's Practice Circular 1 of 2006, select one of the below:

To create a record:

| 1. |

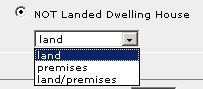

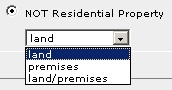

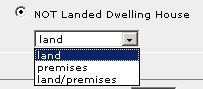

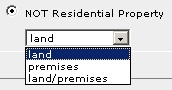

Click on Citizenship/ID/Place of Incorporation/Company Registration No. Certification [C].

Select NOT

Residential Property [R], NOT Landed Dwelling House, Statutory

Declaration [R] or Others [R], if applicable.

If NOT Residential Property [R] or NOT Landed Dwelling House

[R] is selected, you will be prompted:

or

or

Select the appropriate option.

If Statutory Declaration [R] is selected, you may attach Statutory Declaration if

necessary.

If Others [R] is selected, you may enter Others

as appropriate.

|

| 2. |

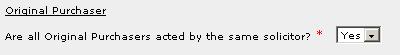

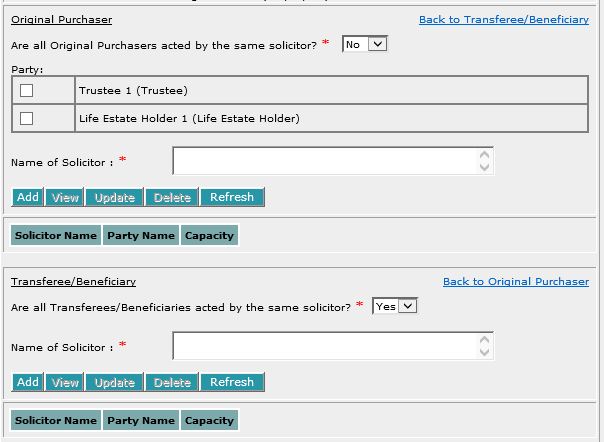

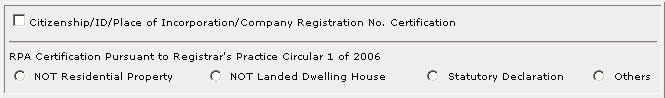

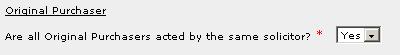

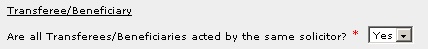

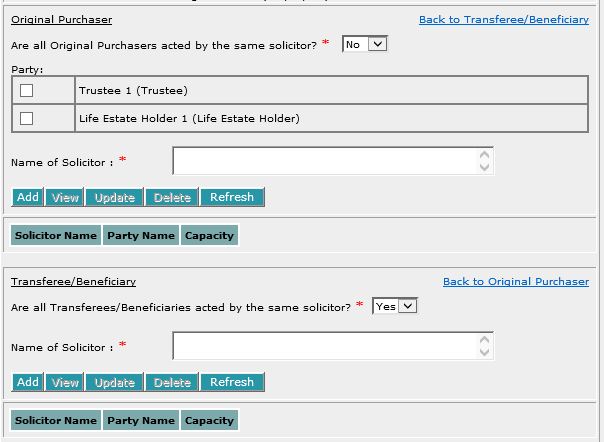

If there are more than one original purchaser entered in the previous section, you will be

prompted:

If there are more than one transferee/beneficiary entered in the previous section, you will be

prompted:

For each party type, select Yes or No to the question above.

The example above shows that for original purchaser, all parties are

not acted by the same solicitor. Therefore, the system will retrieve all

the names of the original purchaser entered in TRANSFEREE

/ BENEFICIARY / ORIGINAL PURCHASER section for selection. Click on

the names [C] and enter the Name of Solicitor [S] to

indicate which parties the solicitor represents. However, for

transferee/beneficiary, all parties are acted by the same solicitor and so it is not

required for the system to retrieve all the names of the transferee/beneficiary

entered in TRANSFEREE / BENEFICIARY / ORIGINAL PURCHASER section

for selection.

|

| 3. |

Click on Add [B] for each party type. Repeat the previous steps to add

more records. |

For each party type, to view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

For each party type, to update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

For each party type, to delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

For each party type, to refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

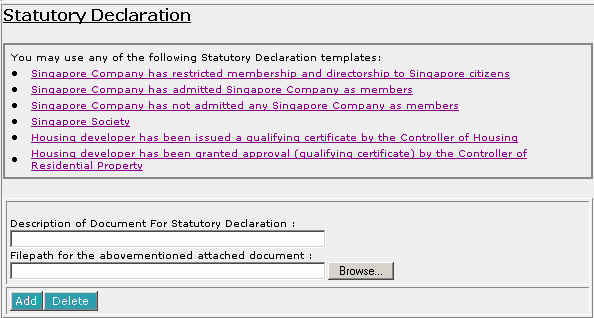

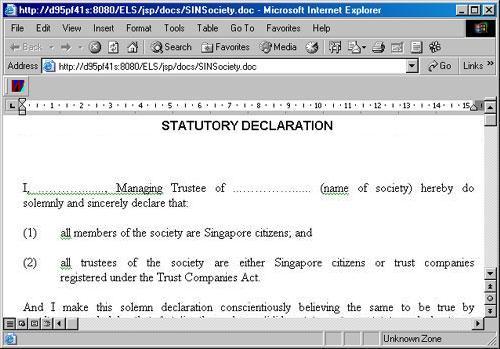

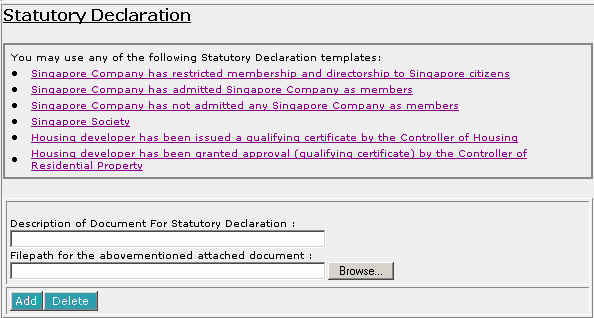

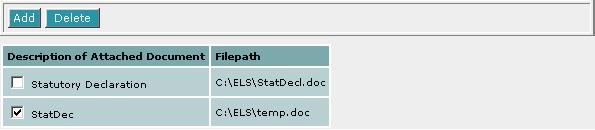

To attach Statutory Declaration:

For each party type, if the parties has been given a Clearance Certificate to purchase the

property, you may use one of the following templates to prepare Statutory

Declaration. It is recommended that you add all solicitors and their RPA

certification before preparing Statutory Declaration.

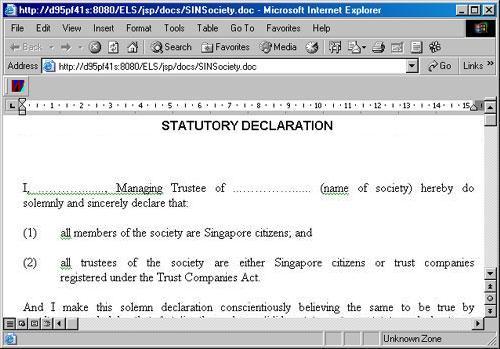

To use any of the form templates, just click on the respective hyperlinks.

The example above shows form template for Singapore Society. You can

enter the relevant information in the template as you would in a Word Document

and save it into your local PC under a filename of your choice.

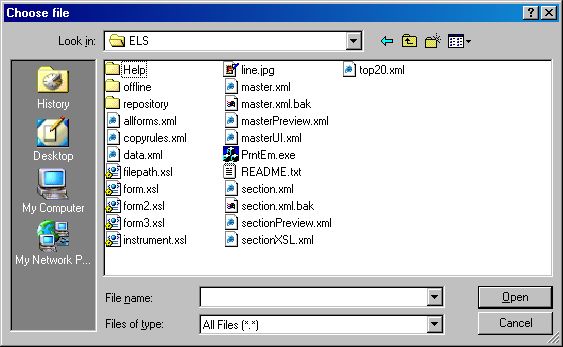

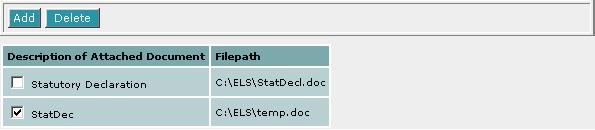

To add the filepath of the document:

| 1. |

Enter the Description of Document for Statutory

Declaration [T] and the Filepath for the abovementioned attached

document [T].

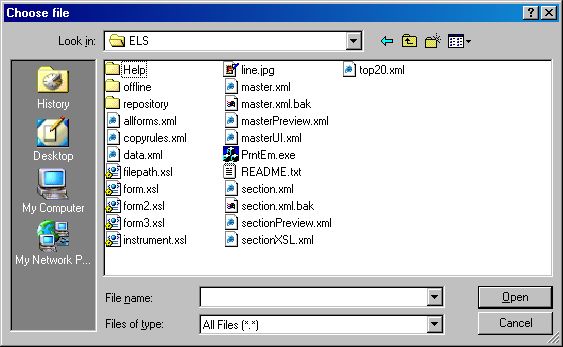

If you do not know the exact path of the file, click on Browse

[B] to look for the file from the "Choose file" dialog box. When

the file is found,

click on Open [B] or double click on the file.

|

| 2. |

Click on Add [B]. Repeat the previous steps to add

more records. |

To delete the filepath of the document:

| 1. |

Select the check box(es) of the record(s) to be deleted. |

| 2. |

Click on Delete [B]. |

When Others [R] is selected, no certificates will be generated

automatically. You will be required to type the Certificates pursuant the

requirements of the Residential Property Act and Land Titles Rules in the

correct format. You may enter the Certificates details [S] up to a maximum

of 4000 characters including spaces (estimated to be about 500 words) in each of

the content box provided.

Special Remarks

Back to Forms

| CERTIFICATE

FOR TRUST CREATED PRIOR TO 1973 |

This section allows you to enter the Certificate For Trust Created Prior to

1973. This section is

dependent on the information entered in the TRANSFEREE /

BENEFICIARY / ORIGINAL PURCHASER section. You may prepare this certificate only if you

have entered one or more trustee for Transferee in the TRANSFEREE /

BENEFICIARY / ORIGINAL PURCHASER section. The compulsory

data items are indicated by the * marked in red. You

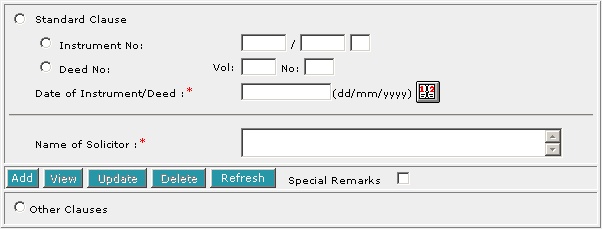

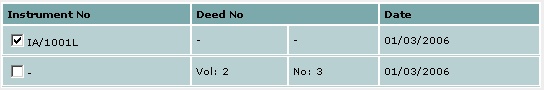

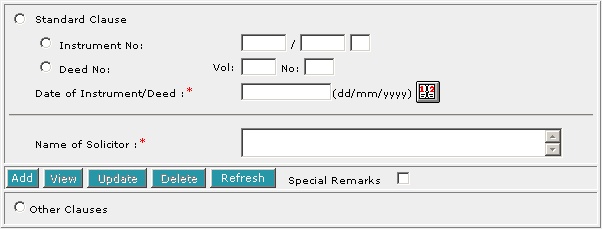

may select Standard Clause whereby you need to state the Name of

Solicitor, Instrument No. or Deed No. and Date of Instrument/Deed to be included

in the clause. If Standard Clause is not applicable, you may select Other

Clauses by which you can create the clause freely.

Select Standard Clause [R] or Other Clauses [R].

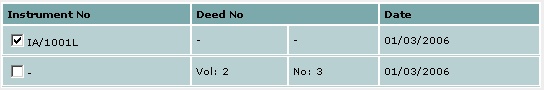

If Standard Clause [R] is selected,

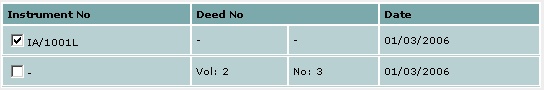

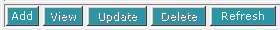

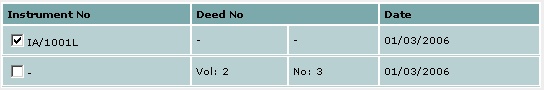

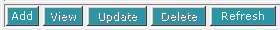

To create a record:

| 1. |

Select Instrument No [R] or Deed No [R]. If Instrument

No [R] is selected, enter the instrument no. If Deed No [R]

is selected, enter the Deed Vol. No.

|

| 2. |

Enter the Date of Instrument/Deed [T].

|

| 3. |

Click on Add [B]. Repeat the previous steps to add more

records.

|

| 4. |

Enter the Name of Solicitor [T] for the standard clause.

|

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in the data entry

screen for viewing.

|

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B].

|

| 3. |

Make the necesssary changes to the displayed record.

|

| 4. |

Select the check box of the record again.

|

| 5. |

Click on Update [B].

|

To delete a record:

| 1. |

Select the check box of the record to be deleted.

|

| 2. |

Click on Delete [B].

|

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

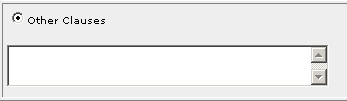

If Other Clauses [R] is selected, a free text box will be provided.

Enter as appropriate.

Special Remarks

Back to Forms

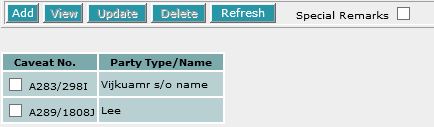

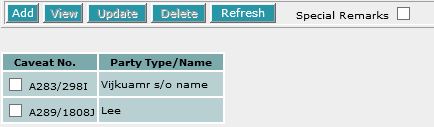

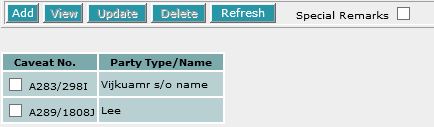

| SIMILAR

INTEREST CONFIRMATION (if any) |

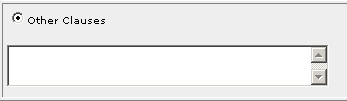

This section allows you to enter the similar interest confirmation. The

compulsory data items are indicated by the * marked

in red.

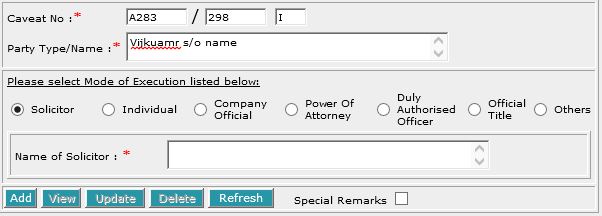

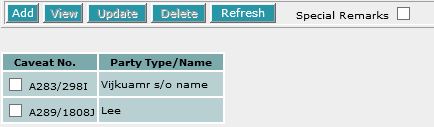

To create a record:

| 1. |

Enter Caveat No. [T] and Party

Type/Name [S].

For example, you are the solicitor acting for all the Transferees, then you may enter the party type "Transferee". However

if you are not acting for all Transferees, then you should specify the

party name as in the above example. These are all the information you

need to enter. The Similar Interest Confirmation will be generated

automatically.

|

| 2. |

Select the appropriate mode of execution.

|

| 3. |

Proceed to fill data accordingly to the radio button selected. Apart

from the mode Others [R], the Similar Interest Confirmation will be generated

automatically. If you have selected Others [R], you will be

required to type the Similar Interest Confirmation in full. Please see Modes

of Execution for Similar Interest Confirmation for details.

|

| 4. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

Back to Forms

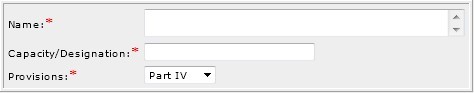

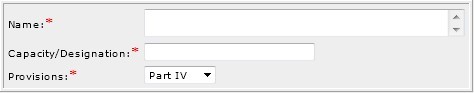

| CERTIFICATE

PURSUANT TO PART IV/IVB OF THE HOUSING AND DEVELOPMENT ACT |

This section allows you to enter the Certificate pursuant to Part IV/IVB of the Housing and Development Act. If the property is sold under Part IV/IVB (residential flat), then this

certificate must be prepared. The compulsory data items are indicated by an *

marked in red.

| 1. |

Enter Name [T], Designation [T] and select Provisions [D]. Certificate will not be printed if no data has been entered. |

Special Remarks

Back to Forms

| CERTIFICATE

OF CORRECTNESS |

This section is dependent on the information entered in the TRANSFEROR

and TRANSFEREE / BENEFICIARY / ORIGINAL PURCHASER sections.

If there is only one party entered in previous sections, you will be prompted:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please

see Modes of

Execution for Certificate of Correctness for details. |

If there are more than one party entered in previous section, you will be prompted:

Select Yes or No. The example above shows the mode

of execution that are available if Yes is selected and if No

is selected.

For each party:

| 1. |

Select the appropriate mode of execution.

|

| 2. |

Please proceed to fill data according to the radio button

selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please

see Modes of

Execution for Certificate of Correctness for details. |

Special Remarks

Back to Forms

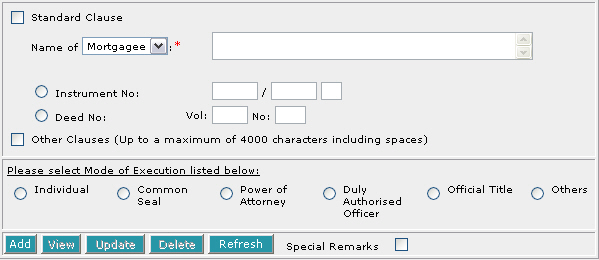

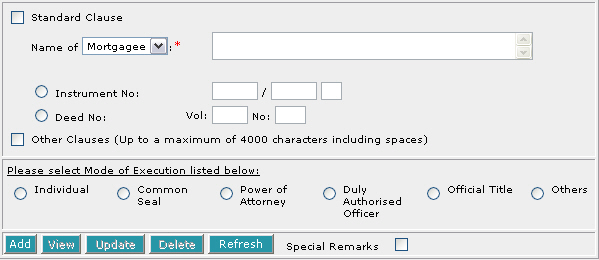

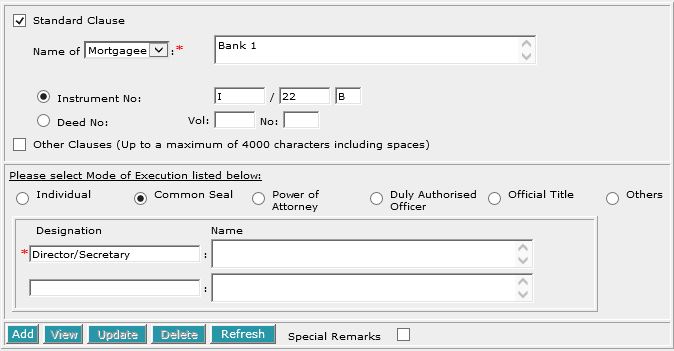

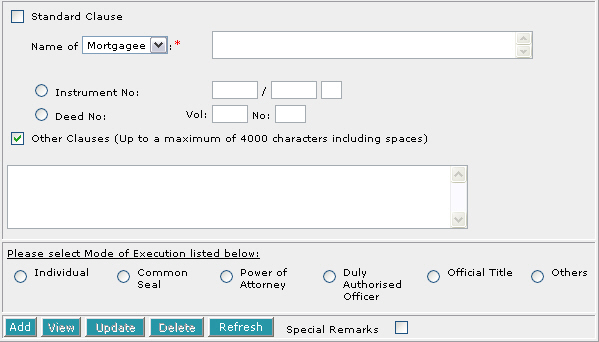

This section allows you to enter the consent of parties with prior interest. The compulsory

data items are indicated by the * marked in red.

To create a record:

| 1. |

Select the checkbox beside Standard Clause and/or Other

Clauses.

|

| 2. |

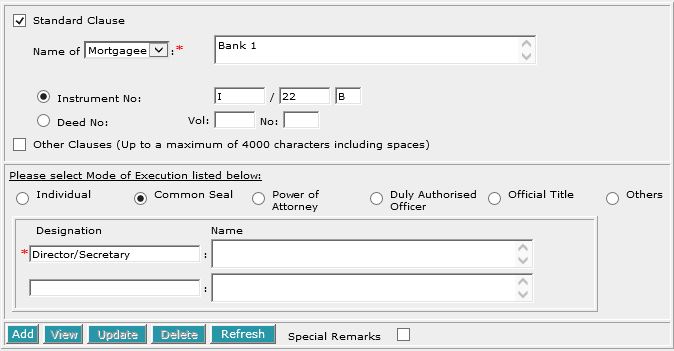

If Standard Clause is selected,

Select Mortgagee, Chargee or Lessor from the drop down next to Name

of [D] and enter the Name [S]. The default is set to

Mortgagee Consent. Select either Instrument No [R] or Deed No [R]

and enter the respective Instrument No [T] or Vol [T] and No

[T]. However, if you are not in a position to enter the name and instrument/deed no at the time of preparation of the form,

you may enter the name and instrument/deed no prior to submission for lodgment. You will be given a reminder message "Please ensure Name and Instrument/Deed No are entered before submission.

Click [OK] to proceed or [Cancel] to enter now".

|

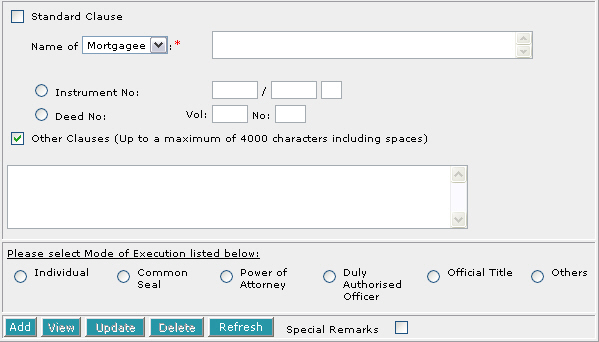

| 3. |

If Other Clauses is selected,

Enter

the Other Clauses [S].

|

| 4. |

Select the appropriate mode of execution. |

| 5. |

Proceed to fill data accordingly to the radio button

selected. Apart from the mode Others [R], the consent will be

generated automatically. If you have selected Others [R], you will

be required to type the consent in full. Please see Modes

of Execution for Consent for details. |

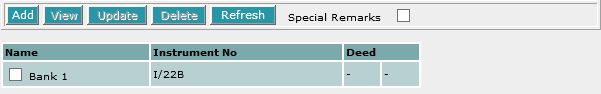

| 6. |

Click on Add [B]. Repeat the previous steps

to add more records. |

To view a record:

| 1. |

Select the check box of the record to be viewed.

|

| 2. |

Click on View [B]. The record will be displayed in

the data entry screen for viewing. |

To update a record:

| 1. |

Select the check box of the record to be updated.

|

| 2. |

Click on View [B]. |

| 3. |

Make the necessary changes to the displayed record. |

| 4. |

Select the check box of the record again. |

| 5. |

Click on Update [B]. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the

screen.

|

Special Remarks

Back to Forms

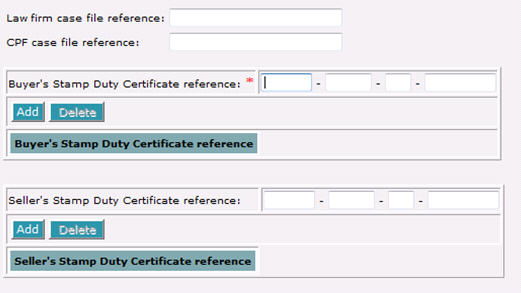

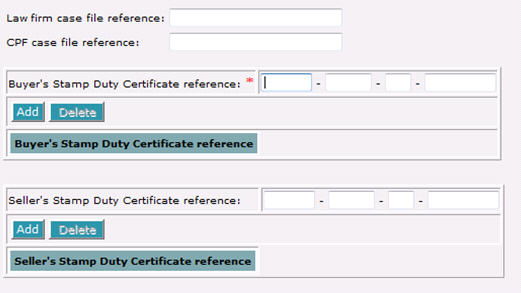

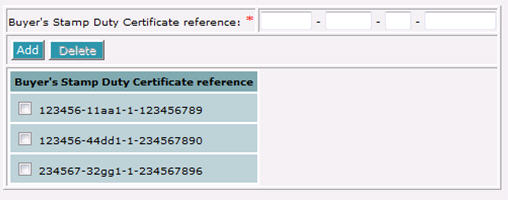

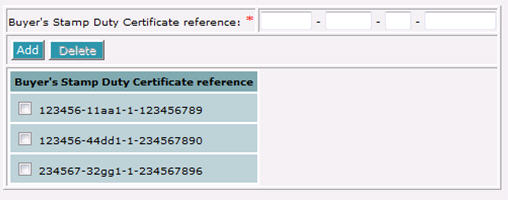

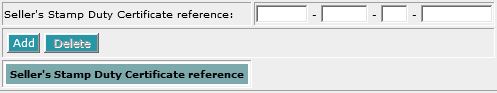

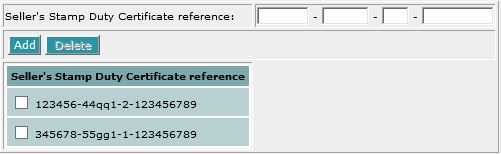

| CASE FILE /STAMP DUTY CERTIFICATE REFERENCE |

This section allows you to enter your case file reference, CPF case file reference,

Buyer's Stamp Duty Certificate reference and Seller's Stamp Duty reference. It is mandatory to enter the Seller's Stamp Duty Certificate reference.

The compulsory data items are indicated by the * marked in red.

| 1. |

Enter the Law firm case file reference [T] if necessary. |

| 2. |

Enter the CPF case file reference [T] if necessary. |

| 3. |

Enter the Buyer's Stamp Duty Certificate reference[T] . |

| 4. |

Enter the Seller's Stamp Duty Certificate reference[T] if necessary. |

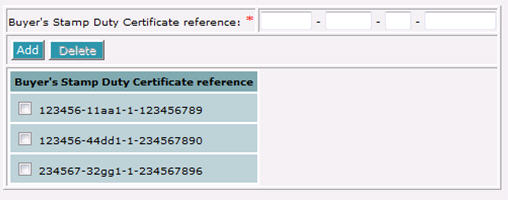

Buyer's Stamp Duty Certificate reference

To create a record:

| 1. |

Proceed to enter the Buyer's Stamp Duty Certificate reference No.[T] |

| 2. |

Click on Add [B]. Repeat the previous step to add more records. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

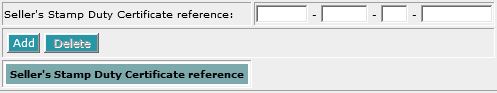

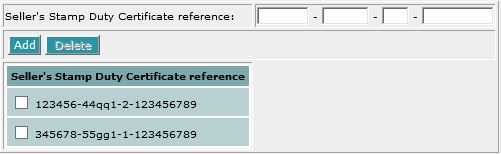

Seller's Stamp Duty Certificate reference

To create a record:

| 1. |

Proceed to enter the Seller's Stamp Duty Certificate reference No.[T] |

| 2. |

Click on Add [B]. Repeat the previous step to add more records. |

To delete a record:

| 1. |

Select the check box(es) of the record(s) to be deleted.

|

| 2. |

Click on Delete [B]. |

Back to Forms

or

or