Select the Title Type [D].

If CT (Certificate of Title) is selected, enter the Vol No [T] and Fol No

[T].

| DESCRIPTION OF LAND - Common Property |

This section allows you to enter the description of land. The compulsory data items are indicated by an * marked in red.

To create a record:

| 1. |

|

| 2. |

|

| 3. | Select the MK (Mukim) or TS (Town Subdivision) and enter the rest of the Lot No. [D, T]. |

| 4. | Enter the Strata Title Plan No [T]. |

| 5. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

If you selected Part in the Extent field, then PLOT/UNIT AND CHILD LOT DETAILS section must be filled in.

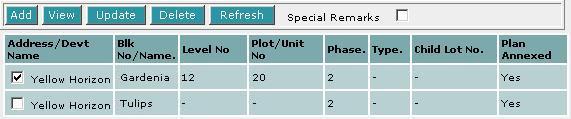

| PLOT/UNIT AND CHILD LOT DETAILS |

This section is compulsory if the Extent field is selected as Part in the DESCRIPTION OF LAND - Common Property section.

To create a record:

| 1. |

|

| 2. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |  Select the check box(es) of the record(s) to be deleted. |

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

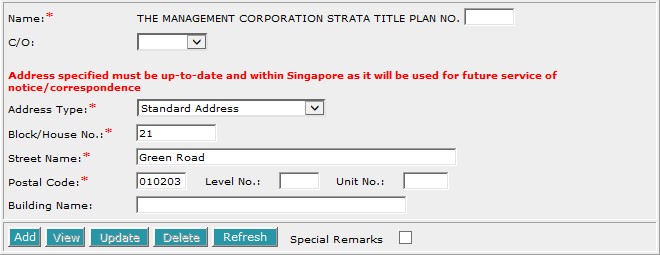

| TRANSFEROR |

This section allows you to enter the details of the above parties. This section is dependent on the information entered in the DESCRIPTION OF LAND - Common Property section. The compulsory data items are indicated by the * marked in red.

To create a record:

| 1. |  Enter the data. For example, Block/House No.[T], Street Name [T] and Postal Code [T]. |

| 2. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

Note:

Information entered in this section will be used for the generation of the EXECUTION BY TRANSFEROR and CERTIFICATE OF CORRECTNESS.

| TRANSFEREE |

This section allows you to enter the Subsidiary Strata Land Register of the transferee. The compulsory data items are indicated by an * marked in red.

To create a record:

| 1. |

|

| 2. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necesssary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

| PRIOR ENCUMBRANCES |

This section allows you to enter the prior encumbrances. The text area is defaulted to Nil. You may change it if necessary.

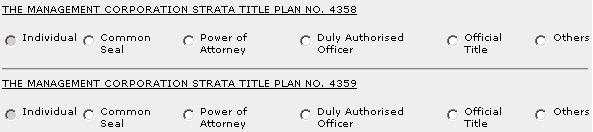

| EXECUTION BY TRANSFEROR |

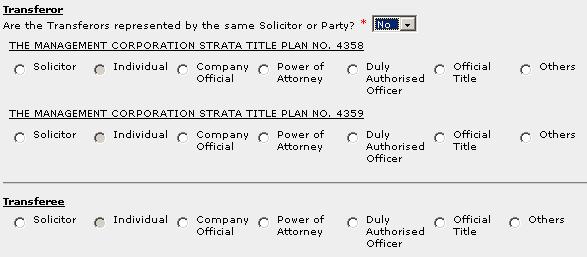

This section is dependent on the information entered in the TRANSFEROR section.

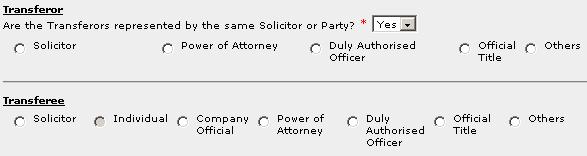

If there is only one transferor entered in previous section, you will be prompted:

![]()

| 1. |

Select the appropriate mode of execution. |

| 2. | Please proceed to fill data according to the radio button selected. Apart from the mode Others [R], the Execution Clause will be generated automatically. Please see Modes of Execution for details. |

If there are more than one transferor entered in previous section, you will be prompted:

![]()

Select Yes or No.

If you have selected Yes:

![]()

| 1. | Select the appropriate mode of execution. |

| 2. | Please proceed to fill data according to the radio button selected. Apart from the mode Others [R], the Execution Clause will be generated automatically. Please see Modes of Execution for details. |

If you have selected No:

For each transferor:

| 1. |

Select the appropriate mode of execution. |

| 2. | Please proceed to fill data according to the radio button selected. Apart from the mode Others [R], the Execution Clause will be generated automatically. Please see Modes of Execution for details. |

| DATE OF INSTRUMENT |

![]()

Enter the Date of Instrument [T].

This is a compulsory data item as indicated by an * marked in red. However, if you are not in a position to enter the date at the time of preparation of the form, you may enter the date prior to submission for lodgment. You will be given a reminder message "Please ensure Date is entered before submission. Click [OK] to proceed or [Cancel] to enter now"

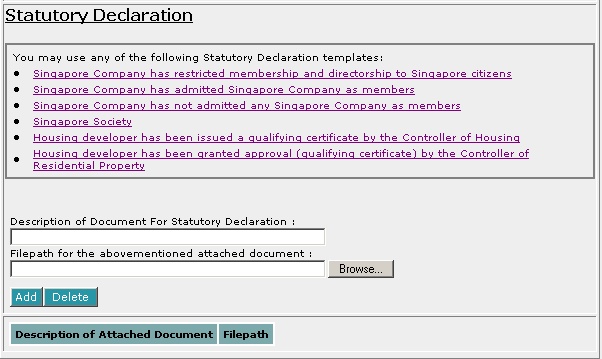

| CERTIFICATE PURSUANT TO THE RESIDENTIAL PROPERTY ACT AND LAND TITLES RULES |

This section allows you to enter the Certificates pursuant to the requirements of the Residential Property Act and Land Titles Rules. You are only required to enter the name of the solicitor who is acting in the matter. You may prepare Certificate verifying ID/Passport No and Citizenship/Place of Incorporation, Certificates pursuant to the Residential Property Act, and Statutory Declarations pursuant to Clearance Certificate, in this section. This section is dependent on the information entered in the TRANSFEROR section. The compulsory data items are indicated by the * marked in red.

For Certification of the ID/Passport No and Citizenship/Place of Incorporation of acquiring party, select the below:

![]()

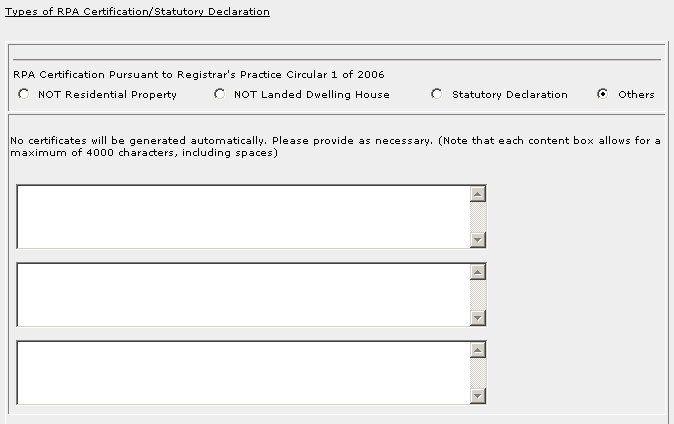

For RPA Certification Pursuant to Registrar's Practice Circular 1 of 2006, select one of the below:

![]()

To create a record:

| 1. |

Click on Citizenship/ID/Place of Incorporation/Company Registration No.

Certification [C]. If NOT Residential Property [R] or NOT Landed Dwelling House

[R] is selected, you will be prompted: If Statutory Declaration [R] is selected, you may attach Statutory Declaration if necessary. If Others [R] is selected, you may enter Others

as appropriate. |

| 2. |

|

| 3. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

To attach Statutory Declaration:

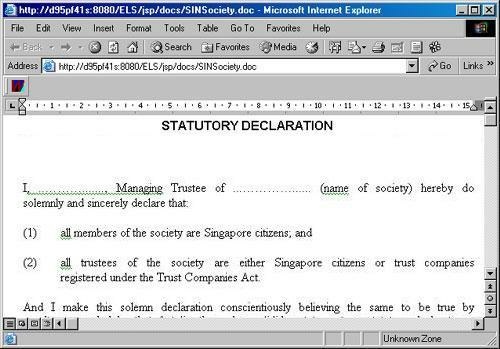

If the Transferor has been given a Clearance Certificate to purchase the property, you may use one of the following templates to prepare Statutory Declaration. It is recommended that you add all solicitors and their RPA certification before preparing Statutory Declaration.

To use any of the form templates, just click on the respective hyperlinks.

The example above shows form template for Singapore Society. You can enter the relevant information in the template as you would in a Word Document and save it into your local PC under a filename of your choice.

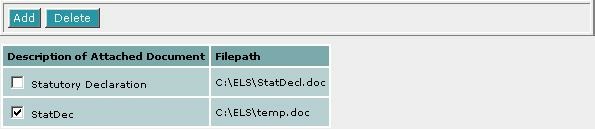

To add the filepath of the document:

| 1. | Enter the Description of Document for Statutory

Declaration [T] and the Filepath for the abovementioned attached

document [T].

|

| 2. | Click on Add [B]. Repeat the previous steps to add more records. |

To delete the filepath of the document:

| 1. |

Select the check box(es) of the record(s) to be deleted. |

| 2. | Click on Delete [B]. |

When Others [R] is selected, no certificates will be generated automatically. You will be required to type the Certificates pursuant the requirements of the Residential Property Act and Land Titles Rules in the correct format. You may enter the Certificates details [S] up to a maximum of 4000 characters including spaces (estimated to be about 500 words) in each of the content box provided.

| CERTIFICATE OF CORRECTNESS |

This section is dependent on the information entered in the TRANSFEROR section.

If there are more than one transferor entered in previous section, you will be prompted:

![]()

Select Yes or No.

If you have selected Yes:

For each party type:

| 1. |

Select the appropriate mode of execution. |

| 2. | Please proceed to fill data according to the radio button selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please see Modes of Execution for Certificate of Correctness for details. |

If you have selected No:

For each party type/party:

| 1. |

Select the appropriate mode of execution. |

| 2. | Please proceed to fill data according to the radio button selected. Apart from the mode Others [R], the Certificate of Correctness will be generated automatically. Please see Modes of Execution for Certificate of Correctness for details. |

| ANNEX A |

This section allows you to enter the strata lot and the share value of the strata lots upon amalgamation. The compulsory data items are indicated by the * marked in red.

To create a record:

| 1. |

|

| 2. | Click on Add [B]. Repeat the previous steps to add more records. |

To view a record:

| 1. |

|

| 2. | Click on View [B]. The record will be displayed in the data entry screen for viewing. |

To update a record:

| 1. |

|

| 2. | Click on View [B]. |

| 3. | Make the necessary changes to the displayed record. |

| 4. | Select the check box of the record again. |

| 5. | Click on Update [B]. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |

To refresh the screen:

| 1. |

Click on Refresh [B] to clear the data entries on the screen. |

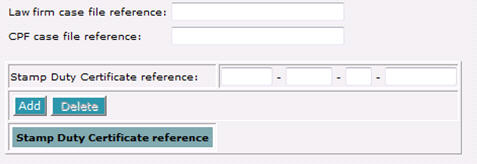

| CASE FILE / STAMP DUTY CERTIFICATE REFERENCE |

This section allows you to enter your case file reference, CPF case file reference and Stamp Duty Certificate reference.

| 1. | Enter the Law firm case file reference [T] if necessary. |

| 2. | Enter the CPF case file reference [T] if necessary. |

| 2. | Enter the Stamp Duty Certificate reference[T] if necessary. |

Stamp Duty Certificate reference

To create a record:

| 1. |

|

| 2. | Click on Add [B]. Repeat the previous step to add more records. |

To delete a record:

| 1. |

|

| 2. | Click on Delete [B]. |